25 countries plus the EU have announced big ambitions for renewable hydrogen production. But how much renewable energy will be needed to make the H2 over the next five years? Nations are not keen to expend new clean energy generation on (expensive today) hydrogen production when their grids are still not emissions-free. According to the IEA, for 2022-2027, their main case forecasts around 50GW of renewable capacity will be dedicated to hydrogen production, consuming 2% of total global renewable capacity growth. Their study looks at China, the EU, the U.S., Asia Pacific, Latin America and MENA. Some will commit a significant proportion of total renewable deployment, seeing hydrogen export as an opportunity (14% in MENA, 17% in Australia, 19% in Chile). Each region faces specific challenges. In general, growth will be enabled by securing customers, regulatory clarity, incentives, and support.

Hydrogen production from renewable electricity is expected to play an important role in reaching long-term decarbonisation goals and improving energy security. While less than 1% of global hydrogen production comes from renewable energy sources today, renewable hydrogen is receiving increasing policy attention. A total of 25 countries, plus the European Commission, have announced plans that include hydrogen as a source of clean energy, and several have begun to introduce financial support schemes.

Project pipelines for hydrogen electrolysers

As a result, project pipelines for using electrolysers to produce hydrogen from renewable electricity have swelled in recent years, with projects at various stages of development. This momentum is expected to increase renewable capacity needs, but the question is: By how much?

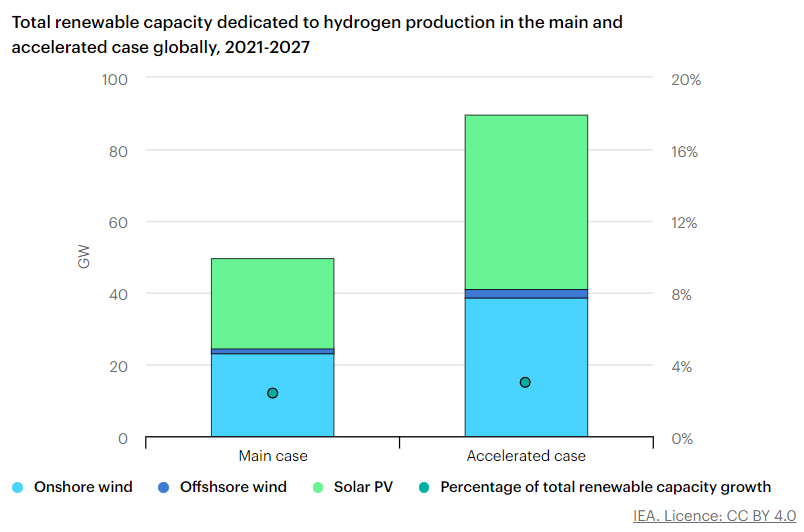

Using 2% of total renewable capacity growth

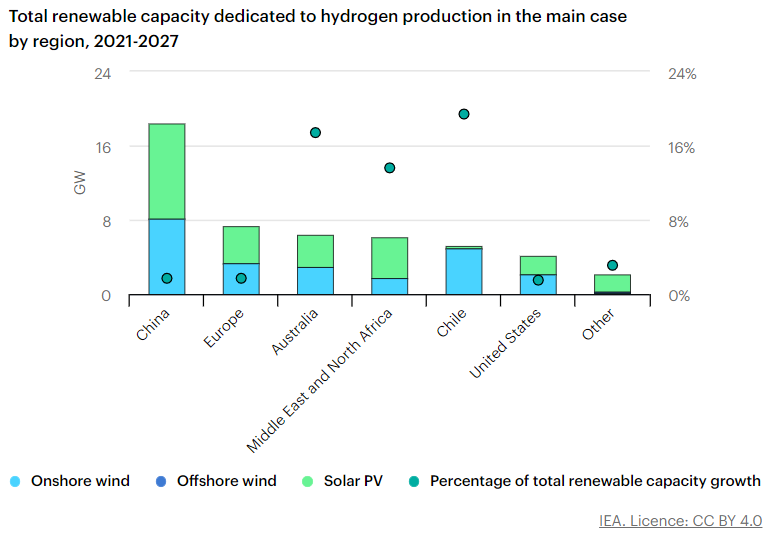

For 2022-2027, the main case forecasts around 50 GW of renewable capacity to be dedicated to hydrogen production, accounting for 2% of total renewable capacity growth. China leads expansion, followed by Australia, Chile and the United States. Together, these four markets account for roughly two-thirds of dedicated renewable capacity for hydrogen production.

Globally, new capacity is split evenly between PV and onshore wind, although regional shares vary depending on resource availability. For instance, solar PV makes up most of the growth in the MENA, while in Latin America the electrolyser project pipeline is expected to be mostly filled by onshore wind projects in Chile. Given their long lead times, offshore wind projects account for less than 1% of new renewable capacity built for electrolyser plants between 2022 and 2027.

China

China is expected to deploy over 18 GW of dedicated renewable capacity by 2027, prompted by the central government’s goals to decarbonise industry and transport as well as an industrial policy on electrolyser manufacturing. While the central government announced renewable hydrogen production targets in its 14th Five-Year Plan, the main catalysts for growth are provincial and local-level policies.

Thus, expansion is expected to be concentrated in provinces with good solar and wind resources and specific targets for renewable hydrogen production, such as Inner Mongolia, which aims to produce 500,000 tonnes/yr of renewable hydrogen – more than twice the national target. Other key drivers are access to affordable financing through state-owned enterprises and to industrial clusters for new project development. Many new electrolyser projects are large demonstration plants located in industrial hubs that can offer economy-of-scale savings, lower unit manufacturing costs and access to local off-takers.

Uncertainties in China

Demand for renewable hydrogen, which is a forecast uncertainty, will determine the pace of dedicated renewable capacity expansion. While many provinces include hydrogen in their industrial development strategies and identify production targets, not all specify that production must be from renewable sources. Furthermore, demand-side policies such as fuel-cell vehicle targets are emissions-agnostic and therefore do not guarantee new demand creation specifically for renewable hydrogen, especially if it costs more than hydrogen made from non-renewable resources.

Transport infrastructure limitations may also slow the pace of hydrogen industry development, as provinces rich in renewable resources are located far from new demand centres. Also adding uncertainty to the size of future renewable capacity projects is how much electricity from the grid will be used and whether it can be certified as renewable to meet provincial targets.

Europe

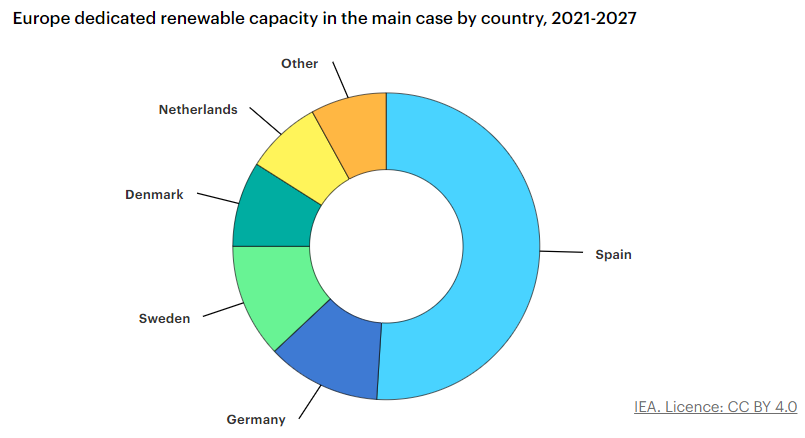

Meanwhile, Europe is expected to deploy 7 GW of dedicated renewable capacity for hydrogen production during 2022-2027, encouraged by decarbonisation goals and, more recently, the need to strengthen energy security by displacing Russian gas. Spain is in the lead, accounting for half of Europe’s growth, followed by Germany, Sweden, Denmark and the Netherlands. The main drivers are ambitious electrolyser goals, supported by financial incentives. While the European Union is considering setting an electrolyser target of 44 GW by 2030, REPowerEU modelling scenarios suggest that 65?80 GW would be required to decrease Russian gas imports.

In the meantime, several member states have already formulated their own hydrogen strategies with electrolyser goals for 2030 (e.g. Germany and Spain). Projects that are financed are at least partially funded by public support, for instance through the Important Projects of Common European Interest (IPECI) programme, or by other state-specific funds. For example, Spain is providing financial support from funds allocated to Covid-19 crisis recovery in its National Recovery and Resilience Plan.

Uncertainties in Europe

There are two key uncertainties in the forecast for dedicated renewable capacity expansion in Europe. The first is regulatory, concerning how hydrogen will be defined as renewable and how additionality will be implemented.1 Developers are awaiting clarity on how electricity from the grid will be monitored to qualify hydrogen production as renewable. This will ultimately affect size and location decisions for dedicated onsite solar and PV wind capacity.

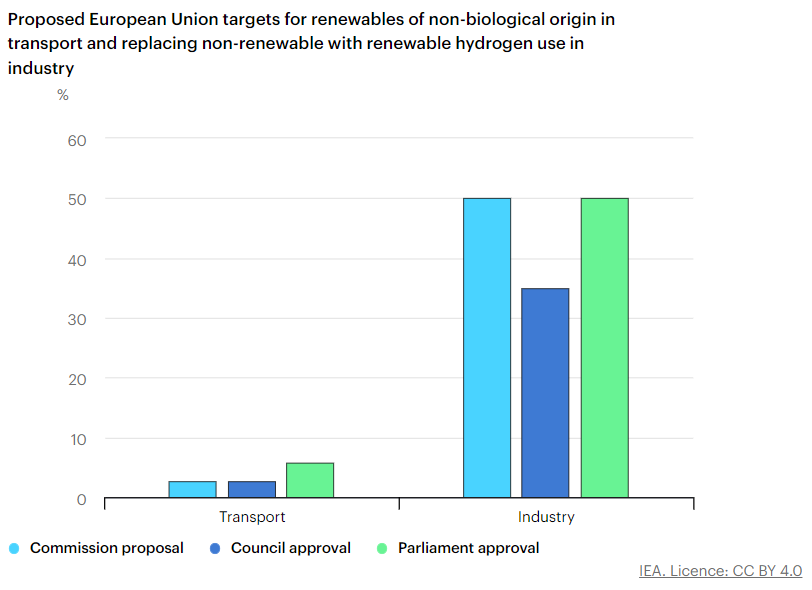

Second, policy uncertainty over industry and transport mandates makes it challenging to assess renewable hydrogen demand potential and plan new electrolyser investments. The European Union is considering three different proposals for binding targets for renewables in existing hydrogen use in industry (ranging from 35% to 50%) and renewables of non-biological origin in transport (2.6% to 5.7%), but a final decision has yet to be taken. Whether developers will be able to secure off-takers and bring projects to financial close also poses a risk to the forecast.

Asia Pacific, Latin America and MENA

Producing ammonia for export is the main impetus for dedicated renewable capacity expansion in the Asia Pacific, Latin America and MENA regions. Dedicated renewable capacity is expected to reach a combined 19 GW, led by Australia, Chile, Oman and Saudi Arabia. Large electrolyser project pipelines have emerged in these countries owing to the availability of space, the presence of shipping ports along strategic trade routes, and access to low-cost renewable electricity thanks to ample solar and wind resources.

The share of renewable capacity dedicated to hydrogen in these markets is higher than in other regions, accounting for 14% of total renewable deployment in MENA, 17% in Australia, and 19% in Chile, compared with 2% globally. While most projects are still at the feasibility stage, our forecast assumes that government support will help move projects to financial close, as these countries all aim to obtain market shares of low-carbon fuel exports. In fact, the Australian and Chilean governments have already funded developers, and state-owned enterprises are involved in planned projects in Oman and Saudi Arabia.

Focussed on exporting

For renewable hydrogen exporters, securing off-takers to finance planned projects is a key forecast uncertainty, but policies of importing countries to stimulate demand can help address this challenge. For instance, the European Union proposes to import 10 Mt/yr of renewable hydrogen by 2030. Germany announced funding of EUR 4 billion will be awarded through competitive tenders through the H2Global initiative to specifically bridge the cost gap between renewable hydrogen imports from non-EU countries and domestic buyers. However, importer countries’ decisions on the emissions intensity levels required for hydrogen imports to qualify for targets and support remains an uncertainty for exporting markets. Rules and regulations defining threshold levels will affect project viability and influence decisions on technology choice and oversizing.

United States

Unprecedented federal policy support for low-carbon hydrogen in the United States is expected to be responsible for 4 GW of dedicated renewable capacity additions, or 1.5% of total renewable capacity expansion expected over 2022-2027. In 2022, the IRA introduced tax credits based on the emissions intensity of hydrogen production. Renewable hydrogen could be eligible for up to USD 3.0/kg if labour and wage criteria are met. This incentive, coupled with state-specific support in the form of grants, loans and tax breaks, is expected to drive growth.

However, dedicated renewable capacity expansion will also depend on the business model chosen for new electrolyser projects. Some projects in the pipeline are being developed through long-term contracts with existing solar PV projects or operating hydropower plants. The main threat to forecast growth is the potential for long project development periods, depending on equipment availability and permitting and regulatory approval wait times.

Project design and business model strongly influence forecasts for renewable capacity dedicated to hydrogen production. Electricity can be supplied from the grid or generated onsite by dedicated renewable plants, or a combination of both. The supply choice will depend mostly on the business model used by the developer, the regulatory requirements for hydrogen to qualify as renewable, and the stability of hydrogen supply needed by the off-taker. When new renewable capacity is built, sizing is highly project-specific and depends on cost optimisation based on multiple factors, including location, the number of full-load hours expected, regulatory requirements to meet renewable thresholds, and whether additional capex needs to be recuperated to provide a stable supply or conversion to other fuels.

Securing customers, regulatory clarity, incentives, support

Given the considerable number of policy uncertainties, market challenges and project-specific variables affecting dedicated renewable capacity growth, we took a conservative approach in our main-case forecast. Thus, growth could be 80% higher (90 GW) in our accelerated case if certain challenges are addressed. Securing off-takers to bring projects to financial close and obtaining regulatory clarity over definitions of low-emissions hydrogen could be the most important factors to unlock development of the project pipeline.

For example, policy actions to support demand creation for low-emission hydrogen, particularly in the industry and transport sectors (e.g. through mandates, public procurement and auctions) could increase the number of willing buyers; and financial incentives to help reduce production costs could improve the competitiveness of renewable hydrogen with other fuels and raise the likelihood of securing off?takers. Investors would be able to move forward with planned projects once they have regulatory clarity over what qualifies as renewable hydrogen and how electricity is accounted for. Policies that help lower costs associated with transport and reconversion of ammonia and other hydrogen-based fuels would encourage the development of international markets for renewable hydrogen.