Without a concerted effort by governments and international financial institutions to harmonise standards and strengthen incentives for investments in decarbonisation across the developing world, mid-century net-zero targets will slip out of reach. Three issues, in particular, warrant greater attention.

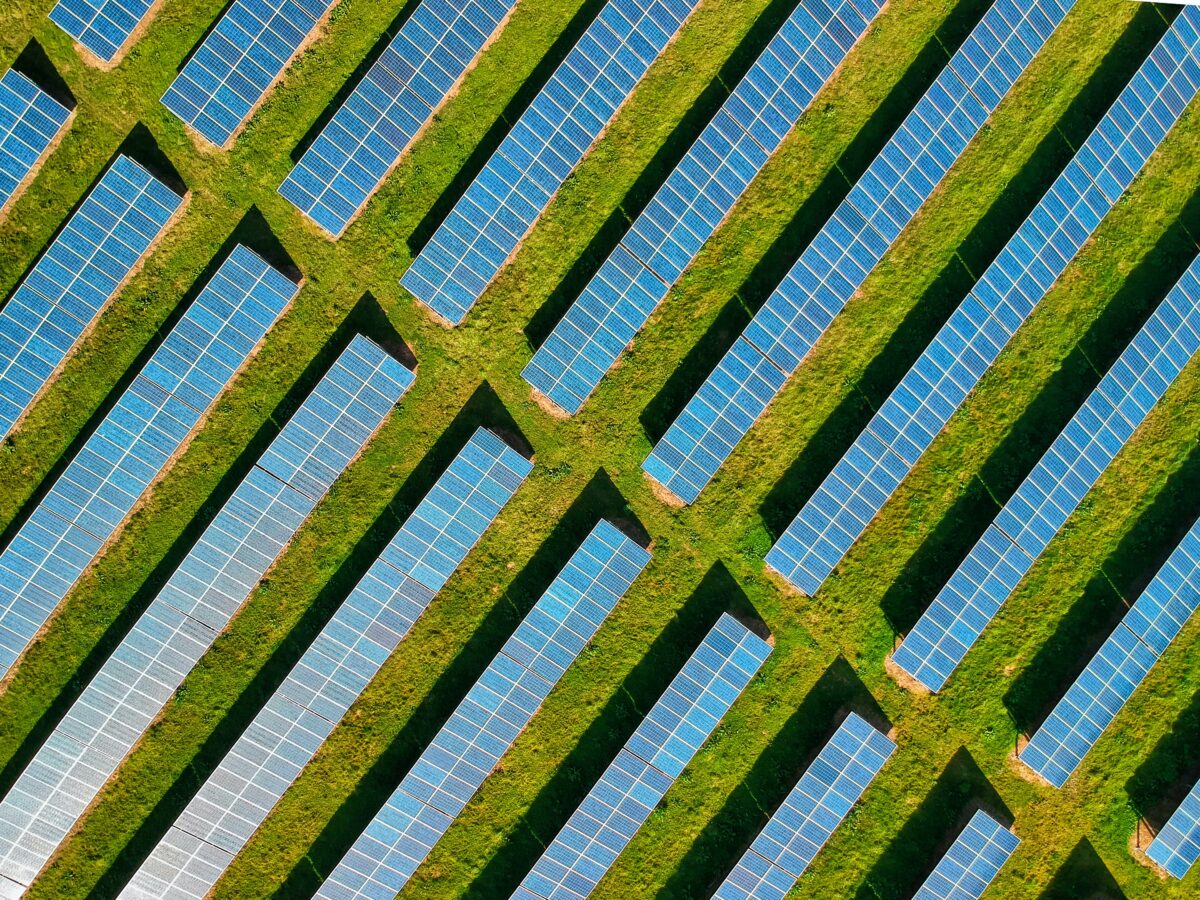

Workers clean solar panels in Yamunanagar, Haryana state, India. Image: IWMI Flickr Photos, CC BY-SA 3.0, via Flickr.

Recent estimates suggest that the developing world will need US$1 trillion of external climate finance annually by 2025, and US$2.4 trillion per year by 2030, to meet the goals enshrined in the Paris climate agreement. But these targets will not be met unless international financial institutions and governments create stronger incentives, paying special attention to three key areas.

First, the world needs a more robust and consistent international process of price discovery for new offerings such as carbon offsets, green hydrogen, direct carbon capture, and battery storage. Because price-discovery mechanisms currently vary from country to country, the international community must come together to establish an overarching framework, which, by enabling offtake (pre-purchase) agreements, would help clean energy manufacturers attract more investment, escaping the “chicken-or-egg” scenario in which many currently find themselves.

A credible international carbon price is crucial for driving greater investment toward clean energy projects, as well as for gradually reducing – and eventually eliminating – fossil-fuel subsidies. Speaking at the United Nations Climate Change Conference (COP27) last November, the International Monetary Fund’s managing director, Kristalina Georgieva, stressed that the price of carbon should rise to US$75 per ton by 2030 to impel consumers and businesses to change their behavior. But in 2021, the global average carbon price was just US$3 per ton (though some regions have far exceeded that). To get to US$75, policymakers will have to work closely together at the global level, finding new ways to bring detractors on board.

A second important issue is the establishment of multi-sovereign loan guarantees, which are needed to strengthen the creditworthiness of clean energy projects and attract more private capital to developing countries. Leveraging this mechanism to its full potential will require clearer assessment standards. Equally, boosting the sums of climate finance requires better concessional rates to companies and entities involved in the shift to clean energy. The IMF and multilateral development banks (MDBs) have a significant role to play here, as do national banks at the local level.

Multi-sovereign guarantees and other climate-finance initiatives should be applied across regions and spread throughout the value chain, from the mining of minerals and equipment manufacturing to clean energy generation and transportation. Getting to scale will require reforms to multilateral lenders’ shareholding arrangements and risk-tolerance standards, as well as faster disbursements and greater transparency concerning investment data.

Finally, the international community needs to forge a consensus on green-investment standards. A May 2022 proposal for a “green hydrogen standard” was a step in the right direction, but it remains to be seen if it will be approved and adopted by all. Even more to the point, the world still needs to agree on emissions-mitigation standards in areas such as carbon capture and “offsets” – an urgent priority that governments should take up at the G20 meetings or COP28 later this year.

My own country, India, has made huge strides in renewables in recent years, becoming the third-largest renewables market in the world. With the government having set a target of net-zero emissions by 2070, developments are now moving fast. Since COP26 in November 2021, India has introduced a national hydrogen plan and established new incentives for electric-vehicle and battery manufacturers.

My company, ReNew Power, has been able to scale up its portfolio of clean energy assets to 13 gigawatts, as well as bringing forward its carbon-neutrality target by ten years (to 2040). Yet, as it stands, India is still the world’s third-largest emitter of greenhouse gases, and much of its clean energy investment has come from domestic sources. As strong as our climate commitments are, developing countries like India need external support to shift away from traditional energy sources such as coal.

COP27 brought a major advance with the last-minute agreement on a “loss and damage” fund to support the developing countries that are being hit hardest by climate-related disasters. But MBDs and governments can and should be doing more to encourage climate investment in developing countries. For their part, MDBs need to make greater use of concessional finance, including grants, to mobilise investments where the benefits are shared globally. Helping middle-income countries move away from coal should be a top priority, along with offering stronger borrowing terms and de-risking clean energy investments across the developing world.

Without a greater impetus from governments and global financial institutions, there is a risk that by the time global economic conditions improve, the window for achieving net zero by mid-century will have already closed. We must not let that happen.