The Section 45Y and Section 48E credits replace the Section 45 production tax credit and Section 48 investment tax credits for renewable electricity production that had been in place for approximately two decades. The new credits are currently in place until 2032.

According to Treasury, the final rules aim to provide clarity and certainty around what type of clean electricity zero-emissions technologies qualify for the 45Y and 48E credits, including wind, solar, hydropower, marine and hydrokinetic, geothermal, nuclear, and certain waste energy recovery property. The final rules also provide guidance to clarify how combustion and gasification technologies can qualify in the future – including on how lifecycle analysis assessments compliant with the statute will be conducted.

The the final rules include an extensive discussion of public comments Treasury received regarding various aspects of the use of biomass and biogas in renewable electricity generation. For facilities that produce electricity though combustion or gasification (C&G facilities), the rules require that taxpayers must substantiate that the source of such fuels or feedstocks used are consistent with the taxpayer’s claims. In addition, if a qualified facility uses feedstocks that do not have marketability, but which are indistinguishable from marketable feedstocks (for instance, after processing), the taxpayer will be required to maintain documentation substantiating the origin and original form of the feedstocks. To ensure that C&G facilities that utilize biomass feedstocks meet the statutory requirement of a net greenhouse gas (GHG) emission rate not greater than zero, Treasury and the IRS said they anticipate it may be appropriate to require or encourage taxpayers to maintain third-party certification that verifies that their facilities meet the criteria and that the lifecycle emissions analysis (LCA) has found are necessary for a facility to meet the statutory requirement.

To determine the GHG emissions rate of a C&G facility that produces electricity from biogas, renewable natural gas (RNG) derived from biogas, or fugitive sources of methane (or hydrogen derived from methane from these sources) as a fuel or feedstock, the final rules indicate that measurements of GHG emissions must consider all direct and significant indirect emission associated with the production of electricity. This includes the consideration of the alternative fates of that methane, including avoided emissions and alternative productive uses; the risk that the availability of tax credits creates incentives resulting in the production of additional methane or otherwise induces additional emissions; and observable trends and anticipated changes in waste management and disposal practices over time as they are applicable to methane generation and uses.

For landfill gas, the alternative fate must be flaring. For methane from wastewater sources, the alternative fate must be flaring of gas not used to heat the anaerobic digester. For methane produced from animal waste, the emissions associated with producing and transporting such biogas must use an alternative fate derived from the national average of animal waste management practices, which results in a carbon intensity (CI) score of 51 gCO2e/MJ, where ethe MJ basis refers to the lower heating value of the methane contained in the biogas prior to upgrading, according to the final rules.

The rules prevent a book-and-claim accounting system from being used to establish or claim the energy attributes of biogas, RNG or any other type of methane. They also specify that a facility’s GHG rate must not include any qualified carbon dioxide (as defined in section 45Y(c)(3) of the final rule) that is produced in the facility’s production of electricity, captured by the taxpayer, and stored or utilized by the taxpayer.

In its Jan. 7 announcement, Treasury noted the U.S. Department of Energy’s National Labs are currently analyzing the lifecycle emissions of electricity production using certain biomass technologies, based on the requirements in the final rules. Once complete, the agency said it expects that analysis to provide additional clarity for taxpayers.

To receive the full value of the credits, taxpayers must meet standards for paying prevailing wages and employing registered apprentices. The technology-neutral Clean Electricity Production and Investment Tax Credits are also eligible for bonus credits related to siting projects in energy communities and meeting certain standards for using domestic content.

The American Biogas Association is calling the Section 45Y and 48E final rules a “missed opportunity” for biogas. “By failing to recognize the benefits of biogas-derived electricity, Treasury's new rules show a complete disregard of climate science and a lack of understanding that biogas systems reduce carbon emissions more than any other technology,” said Patrick Serfass, executive director of the ABC. “As a result, these rules–which Congress intended to be technology neutral–pick winners and losers, while departing from logic and sound GHG accounting.

“In practice, this tax credit provides little to no value, creating economic barriers to recycling and encouraging low-cost disposal instead,” he added. “Small municipalities and rural agricultural communities will be hurt most, at a time when they are being asked to manage their wastes more sustainably. Meanwhile billions of tons of energy-rich waste will remain untapped.

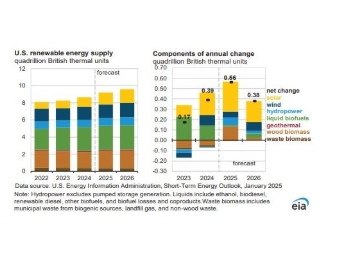

“Existing biogas facilities can generate about 5 gigawatts of clean, firm electricity, but they represent just 12% of what’s possible if all potential biogas facilities were built,” Serfass continued. “That would mean US biogas projects could create 40 gigawatts of generating capacity in total. At a time when both waste and energy demand are rapidly increasing, the federal government should be doing all it can to incentivize the conversion of waste into domestic, clean and renewable energy. It's a shame and a missed opportunity.”

The American Biomass Energy Association is also criticizing the final rules. "We are simply dismayed by the Biden Administration's final rule for 45Y and 48E tax credits,” said Carrie Annand, executive director of the ABEA. “The final rule functionally removes biomass eligibility from a program that we have participated in since 2004. This bill, which originated in Sen. Wyden's office, was intended to be a 'tech-neutral' tax credit for zero emissions technologies based on a lifecycle analysis. What is 'tech-neutral' about revoking eligibility for biomass, which meets this criteria and has relied on the PTC and ITC for the last 20 years?

"In its last Appropriations bill and in every Appropriations bill since 2018, Congress has directed the federal government to consider biomass a carbon neutral energy source. The final rule for 45Y and 48E disregards the will of Congress.

"Our members utilize otherwise unusable materials from the forestry and agricultural sectors to generate renewable energy, supporting livelihoods in rural America and helping to reduce wildfire risk. Biomass is among the few renewable energy sources that supply 'baseload' 24/7 electricity to the grid,” she added. “With an ever-increasing 24/7 energy demand, it defies common sense to disincentivize baseload renewables like biomass.

"We look forward to working with President Trump and the 119th Congress to make this right,” Annand continued.