The number of importing countries dropped from 35 to 15. Major buyers, including Iran, Turkey, and Libya, reduced their purchase volumes, while Egypt cut imports by 8.2 times. Israel, Saudi Arabia, and Yemen also scaled back significantly. However, Lebanon, Tanzania, and Oman showed modest increases, though their overall volumes remain small. This shift reflects a growing preference among some countries for alternative wheat suppliers offering more competitive terms.

For instance, Algeria’s OAIC recently procured 570,000 to 600,000 tons of wheat from various origins at $267.5 per ton C&F. Analysts suggest Russian wheat, priced $2-3 higher, may have lost out to suppliers like Romania, Bulgaria, and Ukraine, who offered better pricing. The global market dynamics further challenge Russian exporters, with Russian wheat (FOB Novorossiysk) priced at $250-254 per ton, compared to $244 for French wheat and $231 for American wheat. These price differences hinder Russia’s ability to maintain its previous export levels amid rising competition.

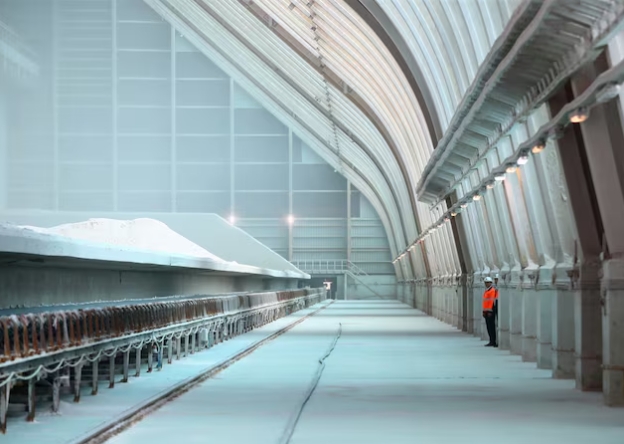

Market participation has also contracted, with the number of exporting companies falling from 67 to 21 and operational ports decreasing from 24 to 11. The Black Sea region ports faced the largest declines, while the Baltic port of Vysotsk recorded an increase in transshipment volumes, standing out as an exception.

Analysts from Sovecon estimate Russia’s wheat exports for the 2024-2025 season at 40.7 million tons, while the US Department of Agriculture forecasts 44 million tons. High prices and limited domestic supply pose challenges to restoring market competitiveness. Despite these hurdles, Russian exporters continue to navigate the evolving global wheat market, adapting to shifting buyer preferences and pricing pressures to sustain their presence in key regions.