The company plans to invest £60bn across its energy networks in the UK and the US by March 2029.

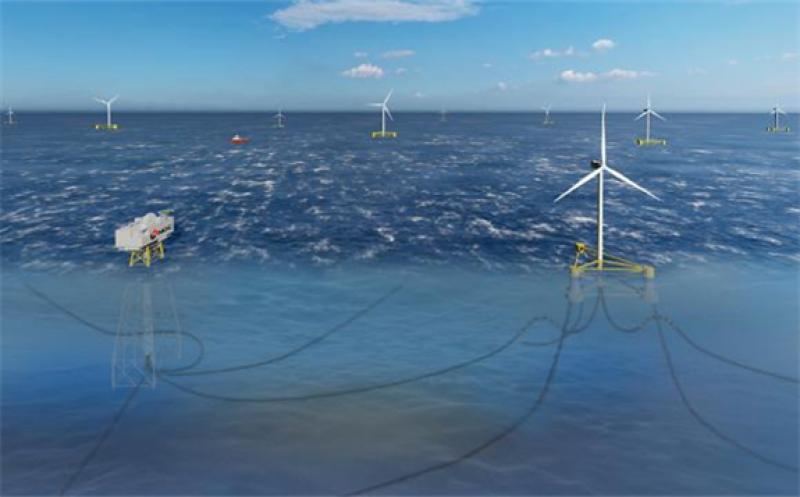

COSW, a partnership between National Grid and Germany’s RWE Renewables, faced challenges following a January 2025 decision to temporarily pause new federal offshore wind leases in the U.S. In April 2025, RWE announced it had suspended work on its U.S. projects due to these changes, impacting National Grid Ventures’ operating profit, which fell by £553 million.

National Grid also recorded £57 million in costs related to the planned sale of National Grid Renewables and £15 million in commodity remeasurement losses during the same financial year. Despite these setbacks, the company remains committed to investing £60 billion in its energy networks and related businesses in the UK and U.S. by March 2029.

This investment, with £51 billion aligning with EU Taxonomy principles, is expected to grow National Grid’s assets to nearly £100 billion. The company projects a 10% compound annual growth rate in assets and plans a cumulative capital investment of £60 billion from 2024/25 to 2028/29, supported by a strong financial position.

For the 2025/26 financial year, National Grid anticipates robust performance, with underlying earnings per share expected to fall within a 6% to 8% growth range from the 2024/25 baseline. The company’s focus remains on delivering reliable and sustainable energy to meet domestic consumption needs.

National Grid CEO John Pettigrew stated: “We’ve made significant progress in the first year of our five-year financial framework, with record capital investment of almost £10bn, 20% higher than 2024, helping to drive regulated asset growth of around 10% this year. At a time of international economic uncertainty, National Grid continues to provide stable and predictable growth through our resilient business model.”

The company aims to ensure affordable and clean energy for its customers while pursuing long-term value for shareholders, navigating challenges in the renewable energy sector with a focus on resilience and sustainability.