Upon completion, Ithaca’s operated interest in the Cygnus field will increase to 85%, enhancing its position in what is described as the largest gas field on the UK Continental Shelf (UKCS). The deal is expected to add approximately 23 million barrels of oil equivalent (mmboe) of 2P reserves and pro forma production of 12.5–13.5 thousand barrels of oil equivalent per day (kboe/d) in 2025.

The acquisition aligns with Ithaca’s strategy to expand its asset base through value-driven mergers and acquisitions, specifically in its core UKCS region. The company stated that the transaction strengthens its portfolio with additional gas volumes, contributing to a more balanced production mix.

Yaniv Friedman, Executive Chairman of Ithaca Energy, stated: “Today’s transaction with Spirit Energy provides further equity in a high-margin, high-quality producing gas asset that we understand deeply through our operatorship. This deal follows our Japex (Seagull) deal announced just two months ago and further demonstrates our growth strategy in action.

“By increasing our stake in Cygnus we add incremental reserves and production to our portfolio at attractive valuation metrics that ticks all of our investment criteria, without adding any complexity. We also see significant upside potential through further infill drilling beyond the next three approved wells. This is the type of deals we like.”

The transaction implies a valuation of under $7 per barrel of oil equivalent (boe) for the 2P reserves, which Ithaca considers a favorable investment in a producing field it operates.

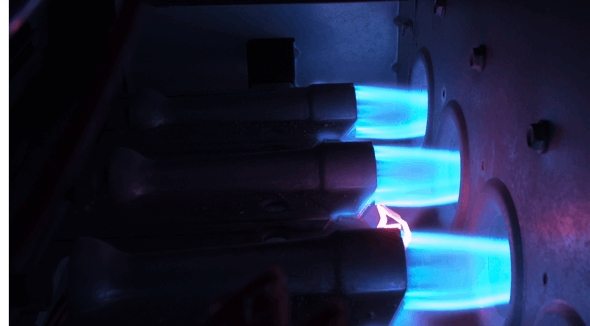

Cygnus, which began production in 2016, is located in the Southern North Sea across blocks 44/11a, 44/11b, and 44/12a, in water depths between 15 and 25 meters. The field consists of two platforms: Cygnus Alpha, a complex of three bridge-linked platforms, and Cygnus Bravo, an unmanned satellite facility.

Currently, 11 wells are producing from the field. Three additional infill wells have been approved, and the Valaris Norway rig is on site to drill two new firm wells, with first production expected in the second half of 2025 and the first half of 2026.

This acquisition follows Ithaca's recent addition of Eni’s UK upstream assets, excluding assets in the East Irish Sea and carbon capture, utilization, and storage (CCUS) operations, further enhancing its upstream portfolio.