Chancellor Rachel Reeves’ spending review allotted £2.5bn from Great British Energy’s funding package to GBN.

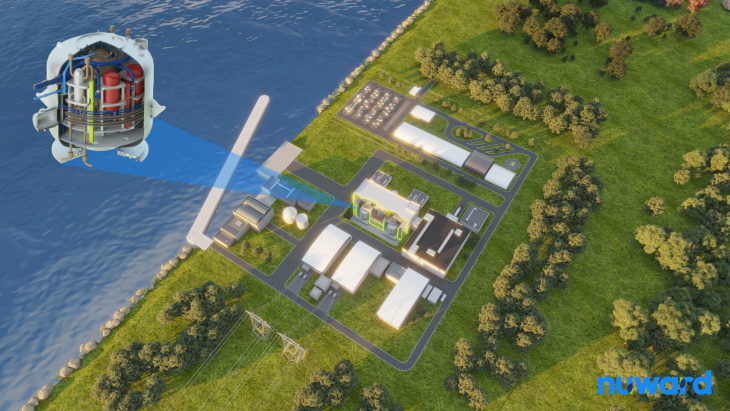

As outlined in Chancellor of the Exchequer Rachel Reeves’ June 2025 spending review, £2.5 billion from the original GB Energy funding will be allocated to the development of small modular reactors (SMRs). This programme is being led by Rolls-Royce in collaboration with Great British Nuclear (GBN), a government agency responsible for advancing the UK’s nuclear capabilities.

The SMR programme, which began in 2023 under the previous Conservative administration, was integrated into GB Energy’s remit following a rebranding move. Just one day prior to the announcement of the spending review, Great British Nuclear was quietly renamed Great British Energy – Nuclear, allowing it to access GB Energy’s funds. Despite this renaming, both GB Energy and GBN continue to function as separate organisations.

As a result of this reallocation, GB Energy is now left with under £6 billion to invest directly in renewable energy projects. While two government officials have maintained that the decision should not be viewed as a cut to GB Energy’s budget, they pointed to the strategic alignment between the goals of GBN and the founding mission of GB Energy. However, a third official noted that the reallocation decision was made just prior to the publication of Reeves’ financial review, suggesting a lack of advance planning.

In response to these developments, Scottish National Party Member of the Scottish Parliament Bill Kidd commented via The National: “The fact Labour is raiding its promised funding for GB energy to spend on nuclear is shocking but not surprising. Scotland is already a global leader in renewable energy, and we generate far more electricity than we consume. Our priority must be a just transition that delivers long-term economic opportunities for all – not more nuclear.”

Further constraints on GB Energy’s operations were also revealed in the review documents. Of the remaining budget, £4 billion has been designated as financial transaction funding, meaning it cannot be used for direct ownership or operation of energy projects. Instead, these funds are limited to grant distribution or minority equity investments in clean energy initiatives.

A government official added that these restrictions reduce GB Energy’s operational independence and are indicative of the Treasury’s intention to maintain oversight over the new public energy body.

The UK Treasury has not issued any public comment regarding the changes.