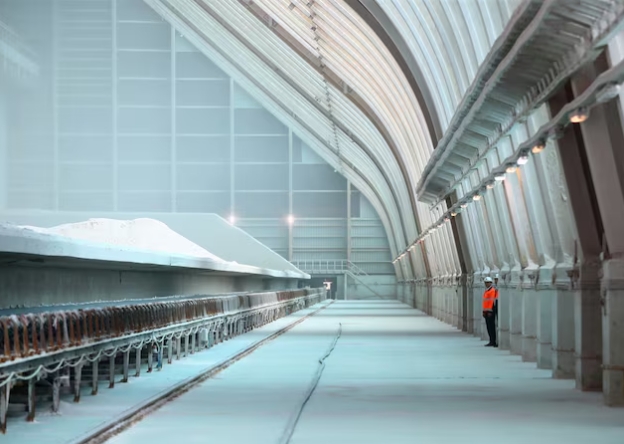

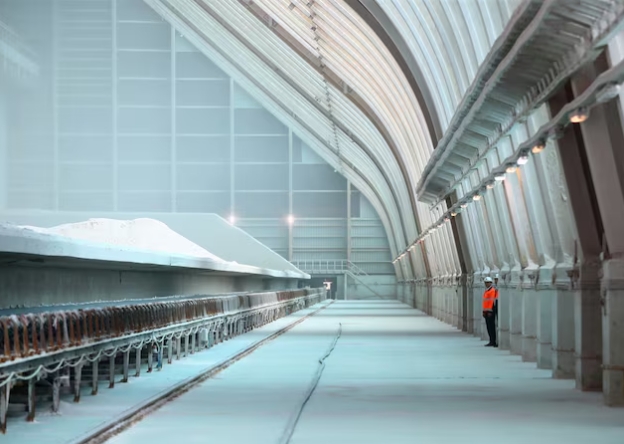

A view shows a finished product warehouse at a processing plant of fertilizer producer EuroChem VolgaKaliy developing the Gremyachinskoe potash deposit in Volgograd region, Russia September 3, 2024.

The EU implemented tariffs on Russian fertilizers starting July 1, set to increase significantly over three years. Russia previously accounted for 25% of EU fertilizer imports. Guryev stated: “We are not afraid of any duties or tariffs. The market is large. The main thing is that we are moving specifically to the BRICS countries’ market.”

Guryev noted: “Today, the BRICS market accounts for almost 50% of all mineral fertilizer consumption, and it is a market that will continue to grow.” Russia, the top global fertilizer exporter, is expected to produce 65 million tons in 2025, with exports to India rising fourfold recently.

Major producers like Phosagro, Uralkali, Eurochem, Acron, and Uralchem supply phosphate, potash, and nitrogen fertilizers. Guryev predicted a potential 30% rise in global fertilizer prices due to EU tariffs, which could lead EU farmers to reduce seeded areas and request more support.

Russia’s focus on BRICS markets aims to counter EU restrictions while leveraging growing demand to strengthen its global fertilizer industry position.