A boat tows a barge of coal across the port of Osaka, western Japan October 23, 2017.

Japan, a leading global coal importer, saw thermal coal imports reach 10.0 million tons in July, up from 6.16 million tons in June, which marked the lowest import level since January 2017. South Korea’s imports rose to 7.49 million tons in July from 5.49 million tons in June, the highest since August 2024. Taiwan’s imports grew to 3.91 million tons from 3.72 million tons in June, the highest since November 2024. The increased imports in these regions reflect heightened electricity demand during the northern summer and the cost advantage of thermal coal over liquefied natural gas (LNG).

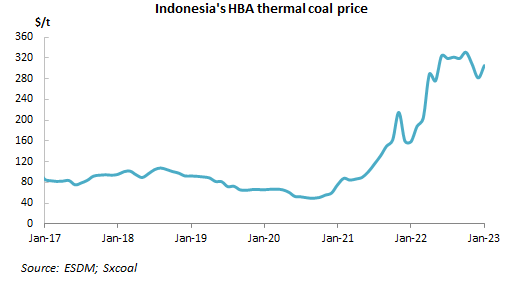

The price of higher-grade thermal coal, benchmarked against Australia’s Newcastle Index, reached $112.06 per ton in the week ending August 1, a 22.4% increase from a four-year low of $91.58 in April, as reported by Argus. Despite this rise, thermal coal remains competitive compared to LNG, priced at $12.10 per million British thermal units (mmBtu) for North Asia delivery in early August, down from a recent high of $14.

In contrast, lower-energy coal, commonly used by China and India, showed modest price increases. Coal with 5,500 kcal/kg energy content reached $67.49 per ton, slightly up from a four-year low of $66.00 in July. Indonesian coal with 4,200 kcal/kg was priced at $41.20 per ton in early August, marginally higher than its recent low of $40.45.

China’s seaborne thermal coal imports rose to 22.78 million tons in July from 18.21 million tons in June, though June marked a three-year low. However, July imports were lower than the 26.99 million tons recorded in July 2024. For the first seven months of 2025, China’s imports fell 17.1% compared to the same period in 2024, driven by a 5% increase in domestic coal production and greater reliance on renewable energy.

India’s thermal coal imports dropped to 11.51 million tons in July from 13.93 million tons in June, the lowest since November 2024. This decline aligns with a 3% reduction in coal-fired power generation in the first half of 2025, while renewable energy output grew by 24.4%, according to official data.

Overall, Asia’s thermal coal imports for the first seven months of 2025 totaled 479.54 million tons, down 8.4% from the previous year, reflecting a broader shift toward domestic supplies and renewables in key markets.