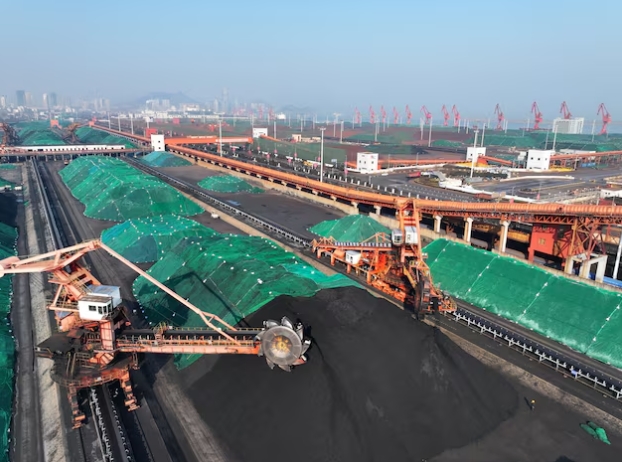

A drone view shows piles of coal sitting next to cranes at a port in Lianyungang, Jiangsu province, China February 16, 2025.

Despite the year-on-year decrease, July imports rose slightly from June, when imports hit a more than two-year low. Warmer weather in June increased electricity demand for air conditioning, boosting overall power consumption and supporting a modest uptick in coal imports.

Toby Hassall, lead coal analyst at LSEG, noted: "A large reduction in imports compared to a year earlier reflects greater coal supply self-sufficiency, as domestic production over the year to date has outstripped coal consumption, which has been suppressed by strong growth in renewable power generation."

Looking ahead, market observers are monitoring potential changes in domestic coal production. On July 20, 2025, the National Energy Administration issued a directive for inspections at coal mines across eight provinces. This move sparked a surge in coking coal prices, which hit the trading limit in multiple sessions due to anticipated supply constraints.

LSEG coal analysts commented: "Such a move by the NEA, if carried out, presents substantial upside risk to domestic coal prices given the potential for a reduction in local production." They added that this could also increase seaborne coal import prices due to the import price arbitrage, a key factor influencing China's import demand.

However, analysts at Kpler, a data analytics firm, cautioned that the NEA directive only temporarily lifted prices and imports. They stated: "The overall outlook remains bearish due to continued domestic output growth, rising renewables, and weakening steel demand."

For the first seven months of 2025, China's coal imports totaled 257.3 million metric tons, a 13% decline compared to the same period in 2024, according to customs data. The combination of strong domestic production and growing renewable energy capacity continues to shape China's coal import trends.