A truck passes by a chemical factory near the Jinjie Industrial Park in Shenmu, Shaanxi province, China November 20, 2023.

The new ETS will implement absolute emissions caps and combine free and paid carbon emissions allowances (CEAs). Unlike the existing system, which relies on carbon intensity benchmarks that decrease over time, the updated approach will set firm limits on total emissions for industries with stable carbon outputs. Companies receiving free CEAs must purchase additional allowances from the market if their emissions exceed their allocated quota during a compliance period. Conversely, firms with lower emissions can sell surplus CEAs.

Xuewan Chen, senior research analyst at LSEG, stated: “Policymakers are now actively tightening the system.” This shift reflects China’s commitment to refining its carbon market to support environmental goals. The regulation will expand the ETS by 2027 to cover major carbon-emitting sectors, though specific industries were not detailed in the announcement. Analysts suggest that chemicals, petrochemicals, papermaking, and domestic aviation are likely candidates for inclusion.

The State Council’s statement also allows banks and financial institutions to participate in the carbon market, a move expected to enhance market liquidity. Mai Duong, Asia-Pacific carbon markets analyst with Veyt, noted: “The (cabinet) document provides much-needed transparency for the development timeline for China's carbon markets.” Duong further emphasized that the plan positions carbon markets as a central tool in achieving China’s decarbonization objectives.

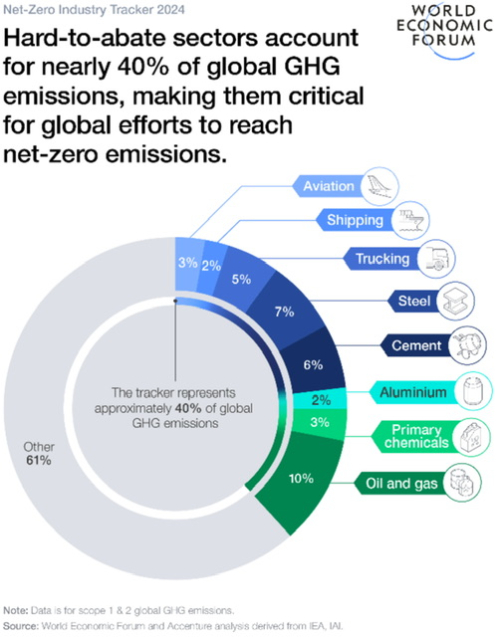

Last September, China announced plans to extend the carbon market beyond the power sector to include steel, cement, and aluminum, covering approximately 60% of the nation’s greenhouse gas emissions. However, analysts note that the large proportion of free allowances has limited the market’s impact on reducing emissions so far. Duong added: “It is positive that China now has a clear timeline for the full scope expansion – but whether this will deliver significant effectiveness in reducing the country’s giant emissions remains to be seen.”

This development underscores China’s focus on building a robust carbon trading framework to support sustainable growth. By setting clear timelines and expanding market participation, the country aims to strengthen its environmental strategy while fostering innovation in high-emission industries.