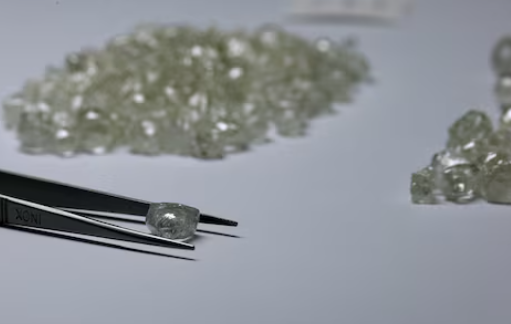

Diamonds are displayed during a visit to the De Beers Global Sightholder Sales (GSS) in the capital Gaborone in Botswana November 24, 2015.

Under the new ten-year agreement signed in February, ODC’s share of diamonds produced by Debswana—a 50-50 joint venture between the Botswana government and De Beers—has increased from 25% to 30%, and it is set to rise further to 40% by the end of the contract period. A clause in the previous deal that prevented ODC from directly competing with De Beers in contract sales has been removed, enabling ODC to expand its marketing options.

Masire said: “We are targeting our first sales through this channel in November, with our first two being pilot sales before we go full scale on the third.” He made the remarks during a mining conference. Earlier this year, Masire told Reuters that the company aims to sell about 40% of its diamond supply through contract sales, with the remaining 60% distributed via auctions, sales to strategic partners, and transactions with Botswana-based companies.

The development comes amid a challenging period for the global diamond market, which has faced a prolonged slowdown due to weakened demand, oversupply, and the growing presence of lab-grown diamonds that have pressured rough diamond prices. In 2023, ODC temporarily suspended rough stone sales as part of an industry-wide effort to address excess inventory. The company held an auction on September 25 but opted to retain its gems, citing “conditions that could have resulted in a significant negative impact on the market.”

Masire said ODC’s revenues in 2024 were around 60% of the previous year’s level because of the downturn, though he noted signs of recovery. The company’s last three auctions recorded small positive margins, improving from the double-digit losses recorded during the same period in 2023.

Diamonds play a central role in Botswana’s economy, accounting for about 30% of government revenue and 75% of foreign exchange earnings. The sustained weakness in global demand has affected the country’s overall economic performance. In 2024, Botswana’s economy contracted by 3%, and the International Monetary Fund projects a further 1% contraction this year.

Despite the current market challenges, ODC’s plan to introduce contract sales represents a strategic shift aimed at increasing flexibility and market access. The initiative aligns with the government’s broader objective of boosting local participation in diamond trading and ensuring long-term stability in one of the country’s most important industries. By expanding its sales channels and adjusting to global market conditions, ODC aims to strengthen Botswana’s diamond sector and maintain its position as a leading player in the global market.