Projects still get greenlighted as Mekong River nations struggle to meet climbing power demand, but concerns on their environmental, social, and economic effects are also mounting.

Whilst the Mekong River has always been a key power resource for the countries that it runs through, governments and utilities are becoming more cautious in developing projects on the river. At the heels of continuous development, there are threats of drought, depletion of river biodiversity, as well as local and cross-border tensions between governments and their constituents.

One of the Mekong River countries, Vietnam, is being held back on its goal to raise hydropower’s generation capacity by falling water levels, as data showed that its large reservoirs have only accumulated 61% of their total volume capacity. Low water levels resulting from climate change may also create a deficiency of 6.4 billion kWh, according to EVN.

Amidst drought issues, hydropower remains vital to Vietnam’s energy security, so the country continued to bolster this sector with some of the largest power projects in 2019. EVN invested $397.92m (VND9.22t) into the expansion of Hoa Binh Hydropower Plant in order to increase capacity and facilitate the further exploitation of the annual excess water discharged by the plant in rainy seasons in order to generate more power.

EVN also invested $276.21m (VND6.4t) into the expansion of Ialy Hydropower Plant, which should break ground a year after the expansion of Hoa Binh plant. This project aims to maximise the utilisation of water flow and limit excess water discharge each year, which should increase the annual average electricity production by 2.22 billion kWh per year.

Vietnam’s mini-hydro push

After 2019, Vietnam will cease to have large-scale projects in its pipeline as it has already deployed those with over 100MW capacity. As a result, the attention of Vietnam’s developers is now focused on small-scale projects, said Dang Chi Lieu , partner at Baker McKenzie.

There are up to 138 small-scaled projects being constructed and 299 projects in investment study phases, according to data from the Ministry of Trade and Industry (MOIT). “Certain hydropower plants are also being expanded to improve capacity,” Dang added.

The government is promoting small-scale hydro by placing new law amendments geared towards incentivising their development. It eyes limiting the sizes of projects that can be covered by the EVN’s obligation to purchase generated electricity through an expandable 20-year PPA, ratified through its Avoided Cost Tariffs (ACT). With the new mechanism, ACT is only applied to renewable energy projects no larger than 30MW.

Limits on the ACT mechanism were imposed to improve consistency in the regulations for the Vietnam Wholesale Electricity Market (VWEM), Dang explained. “Particularly, according to Circular No. 45/2018/TT-BCT, power plants that have been issued with power generation license and have the capacity of larger than 30MW must register and directly participate in the VWEM. Hence, according to the new proposed limits, plants which are participating in the VWEM shall not be eligible for ACT mechanism.”

This new regulation provides incentives to small-scaled hydropower plants in early stages and requires such plants to participate in accordance with market standards in case of expansion of capacity, he added.

For a cluster of cascade hydropower plants for which their ACT PPAs are signed before 1 January 2020, the power developer (seller) may continue the signed ACT PPAs, Dang said. “The impact of the new regulation therefore depends on whether the project has signed the PPA or not.”

But over 470 small-scaled hydropower projects have also been proposed for removal as provincial people’s committees review the pipeline under the eighth Power Development Plan. “The MOIT inspects the investor's compliance in dam safety, replacement forestation, environmental service fee payment, water reservoir operation process and other requirements on licenses (water surface exploitation, power generation),” Dang added.

Tensions in Lower Mekong

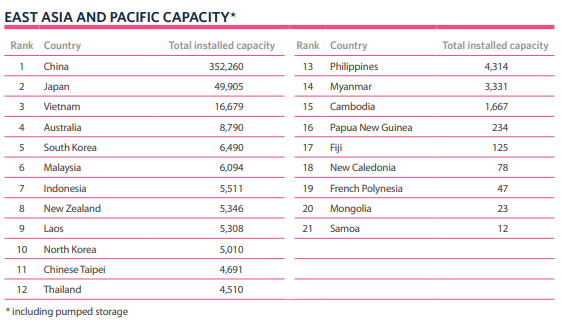

With some of the world’s most important rivers strewn across its landscape, Cambodia is one of the countries best placed to use hydropower as a stable source of electricity. But data from the IHA revealed that the Kingdom has only tapped into 20% of the resource’s technical potential.

The presence of 63 possible sites for small and large projects throughout the country, coupled with rapidly rising electrification rates, has pushed Cambodia to support some of its most ambitious hydropower projects to date. Its 400MW Lower Sesan II project, commissioned in 2018, will boost electricity production by 20% with the power being sold to Electricité du Cambodge (EDC) at a base price of 0.0695 cents per kWh.

Getting this ambitious project across required collaboration with cross-border developers. The Lower Sesan II project is a joint venture between China’s Hydrolancang International Energy (holding a 51% stake), Cambodia’s Royal Group (39%), and Vietnam’s EVN International Joint Stock Company (10%).

This pattern of cross-border collaboration appears across several other hydropower projects. In fact, with the Lower Sesan II entering into operation, Chinese-built hydropower projects in Cambodia have an installed capacity of over 1,300MW and account for half of the country’s total installed capacity from all energy sources. IHA said, “All based on Build-Own-Operate (BOT) contracts, hydropower development has been a key pillar of Sino-Cambodia relations over the past decade and is set to continue as part of China’s Belt and Road Initiative.”

But cross-border collaboration for the ambitious hydropower projects across Mekong River countries is fraught with tensions. Fitch Solutions pointed out that government pushbacks in the upstream countries could intensify for some projects.

The negative public sentiment towards Cambodia, after the collapse of the Xe-Pian Xe-Namnoy dam in 2018 that killed about 71 people and displaced 25,000, could prompt their government to view Laotian hydropower construction like the planned Luang Prabang Hydropower Project less sympathetically and heighten the risk of inter-state tensions in 2020, Fitch Solutions said in a note.

Concerns over Cambodia’s reliance on Chinese developers’ support for its hydropower projects have also stained local sentiment, highlighted by the government’s move to keep a report on the Sambor hydropower dam under wraps as the period for local elections approached. The report, made by the US-based National Heritage Institute (HNI) and commissioned by the Cambodian government, argued that the Sambor hydropower dam “is probably the largest and most destructive dam in the Mekong River basin” as development could destroy migratory fish reproduction in the site.

Even with controversies in its midst, IHA noted that the government views the Sambor dam as an opportunity to generate revenue through exporting its electricity to neighbouring countries including Vietnam and Thailand where regional interconnectors are already in operation. But with environmental and social concerns on its path, a final decision on its future is still to be made.

Apart from Cambodia, Myanmar also made strides in sizing up its hydropower sector. After some delay, the government issued a notice to proceed for both the 1,050MW Shweli 3 and the 60MW Deeoke projects. Shweli 3 in Shan State is considered to be a priority project in order to meet the energy needs of the country over the medium-term and will be developed by a consortium led by French utility EDF.

IHA noted that the International Finance Corporation also released a Strategic Environmental Assessment (SEA) of Myanmar’s hydropower sector, the culmination of a two-year process, which is seeking to help guide sustainable hydropower development with a strong focus on the need for basin-level planning.

Over the past few years, VDB Loi counsel Maxim Kobzev observed the attraction towards Myanmar’s renewables sector. In a note, he said, “Renewables projects have a broader potential lender group, as more and more international lenders shift and prioritise green finance, whilst reducing or completely excluding from their portfolios transactions that relate to fossil fuels. Myanmar is a great illustration of this, as several notices to proceed were signed by the government and sponsors with respect to hydropower projects over the past few years.”

The potential of hydropower also remains unavoidable for Lao PDR, as according to the Mekong River Commission, the country obtains practically all its supply from hydropower in the Lower Mekong Basin.

According to VDB Loi senior counsel Sornpheth Douangdy, development financiers such as ADB and the World Bank, as well as Belt and Road financiers, also play a big role on the lender side in Laos.

“As for sponsors, Lao Holding State Enterprise, Électricité du Laos, and Generation Public Company are the three entities representing the state’s investment in the power sector and are the major players in this sector. A number of hydropower plants, particularly small and medium-sized hydropower plants, are developed by companies that are owned by Lao nationals and businesses,” he said.

The country commissioned a further 254MW in capacity in 2019, but the sector experienced a very difficult year due to the collapse of Xe-Pian Xe-Nam’s saddle dam in July 2018. “Following the collapse, the Laotian government announced an investigation into its causes, a review of all existing and under-construction dams and a halt to proposed projects. The government also established a centre for dam safety management in order to prevent such incidents occurring in the future,” IHA said.

China spearheads global progress

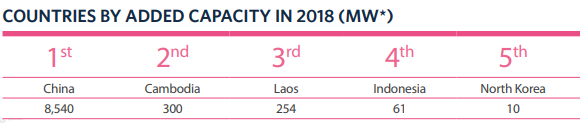

China is still the hydropower king with 8.54GW of capacity additions in 2018, greatly outpacing the installation figures of any country in IHA’s list. Its installed capacity passed 350GW in 2018 with several projects, mainly located in the country’s southwest entering into operation.

However, eclipsing the country’s success in hydropower is its weaker economic conditions that have brought about overcapacity and renewables curtailment. IHA’s latest data in 2018 showed that a whopping 69,100GWh of hydropower generation was curtailed, even greater than the 33,200GWh of wind and solar affected during the period.

The government, with a lot of wasted electricity potential in its hands, introduced the Clean Energy Consumption Action Plan for 2018 and 2020 which emphasised the importance of reforming China’s electricity market, improving provincial interconnections, increasing energy storage (including pumped storage) and enhancing power system flexibility. IHA noted that the Sichuan provincial government also announced plans to establish a “hydropower consumption demonstration zone” with direct power purchase and dedicated power lines for local industrial users.

Inter-provincial power transmission channels have been constructed to export excess hydropower generation and in 2018, two further transmission lines from Yunnan province achieved significant progress. The 800 kV Northwestern Yunnan-Guangdong UHVDC power transmission project with a transmission capacity of 5,000MW was commissioned, and the world’s first UHV multi-terminal DC project, the 800 kV Wudongde–Guangdong and Guangxi transmission began construction.

The Chinese government is also complementing its transmission infrastructure investment with reforms, one of which involves transitioning from a planned dispatch to an electricity spot market that will allow renewables to be dispatched first. Hydropower is expected to benefit from increased generation, IHA said.

“Pilot spot markets, which is the buying and selling of electricity for immediate delivery, are being developed in eight provinces and regions; however, seven of them failed to meet the 2018 deadline and have been postponed and in 2019, the central government will intervene to accelerate their development,” IHA added.

To reduce intermittency of renewables, China is also prioritising pumped storage as part of its energy transition. The 1,200MW Shenzhen station was commissioned in 2018 and is the country’s first large scale pumped storage built in a city, in addition to the 600 MW Qiongzhong station entered into operation.

The country also began the main civil works of three pumped storage projects (1,200MW Fu Kang, 1,800MW Jurong and 1,200MW Yongtai) began construction in 2018, IHA noted. A number of conventional projects were also commissioned, including 1,900MW Huangdeng, 348MW Sha Ping II, 920MW Dahuaqiao and 420MW Li Di stations.

IHA added that ancillary services markets that will better reward the services of pumped storage were successfully implemented in five regional power markets including Northeast China. In November 2018, the government released its third public consultation on their renewable portfolio standard, which sets out provincial wide minimum consumption levels of renewable electricity. The new standard will require designated electricity users to purchase an obligated amount of renewable energy certificates from renewable energy generators, which will further help to increase hydropower consumption and reduce curtailment.