The development of electricity markets in the Association of Southeast Asia Nations (ASEAN) is in a dynamic stage, both for demand and supply. Countries are continuing their path towards increasing level of electrification, while the region’s power industry and policymakers intend to improve the environmental sustainability of the sector in the context of strengthening clean air policies. Mitigating reliance on coal through the diversification of energy sources for electricity generation is becoming an important trend, which paves the way for higher natural gas penetration and scaling-up of renewables.

The Gas Exporting Countries Forum (GECF) attaches special attention to the development of ASEAN’s energy system and its power sector by targeting this matter in research activities and publications, particularly the GECF Global Gas Outlook 2050 (GGO, February 2021) and the new edition of the GGO (slated for release in Q4 2021). Focusing on cooperation with ASEAN, the GECF is keen to promote the dialogue with key regional stakeholders in order to share views and support in addressing energy challenges, including providing a clean and competitive electricity for the region’s economies. One of the examples is the series of joint workshops with the Economic Research Institute for ASEAN and East Asia (ERIA), involving a number of stakeholders with strong intentions to enhance the usage of natural gas and increase its import.

Policy orientations and plans to ensure affordable and sustainable electricity supply

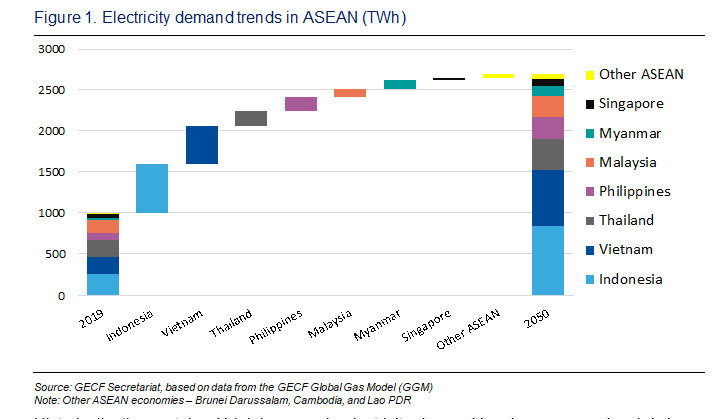

Over the past 20 years, electricity demand1 in the ASEAN community has been rising at a substantial rate of over 6% annually, twice the world average. Of the region’s 10 countries, Indonesia (26%), Vietnam (21%), Thailand (21%), and Malaysia (16%) currently make up almost 85% of the total demand in the region. According to the GGO, this electricity demand is set to continue its strong growth trajectory with an annual pace of 3.2% over the next three decades and to reach 2,690 terawatt hours (TWh) by 2050, propelled predominantly by Indonesia, Vietnam, Thailand, and the Philippines’ economies. It is based on a combination of dynamic economic and population drivers. Particularly, the region’s GDP will more than triple in size and the urbanisation rate is expected to grow from 49% to 66% between now and 2050, when the urban population will expand by 198 million to 525 million in 2050.

The largest contribution to electricity demand will stem from the residential segment, underpinned by higher space cooling requirements and increased household appliance ownership. With electricity’s share in ASEAN’s final energy consumption expected to approach 26% by 2050 (from 15% today), the power sector is slated to undergo a profound

transformation to achieve sustainability goals. Thus, given a wide spread of possibilities to meet surging electricity needs, the future configuration of the power generation mix is open to debates.

Historically, the sustained high increase in electricity demand has been covered mainly by the expansion of coal-fired generation, followed by natural gas and hydropower. In 2017, coal had already overtaken gas to become the primary source of the regional power generation mix and the dominance might persist given the capacity under construction, equal to 20.5 GW, mostly in Indonesia, Vietnam and the Philippines (1). Substantially more capacity of around 56 GW is at the pre-construction phase, although some of potential projects are expected to be reviewed due to environmental considerations, rising public opposition as well as difficulties to secure financing as more banks and financial institutions back away or tighten their policy towards coal-powered projects.

A downward revision of the number of coal-fired projects is confirmed by countries’ recently adopted plans and announcements. For example, the Philippines last year implemented a moratorium on new coal-fired power plants; it will not concern projects that have already been approved or secured permits (2). In Vietnam, within the draft national power development plan for the period of 2021-2030 with a vision to 2045 (draft PDP8, unveiled 22 February 2021), almost half of previously planned coal-fired projects (about 18 GW, approved under the amended PDP7) will be cancelled or delayed until after 2030 (3). Malaysia, in line with the country's latest generation development plan covering 2021-39 (released on 24 March 2021), intends to retire over 7 GW of coal-fired capacity by 2039 and only 2.8 GW of new coal-fired projects should be commissioned in that time (4). In Indonesia, where coal supplies more than 60% of electricity, there remains a determination to reduce the dominance of this source of fuel. The government has declared plans to replace old coal-fired fleet (aged 20 years and older, a combined capacity of over 11 GW) with cleaner power sources. Moreover, Indonesia is also considering setting a net-zero emissions target by 2070 as part of its long-term strategy for reducing carbon emissions and climate resilience (5). This decision could

slow down the ramp-up of coal-fired generation in the country, which has the largest coal pipeline projects in the region.

In this context, countries have started to place greater emphasis on natural gas and renewables’ expansion. In terms of renewables, ASEAN set a target of 35% share in the total installed power capacity by 2025. It will contribute to achieving the aspirational target of integrating 23% renewable energy in the regional energy mix by 2025 (6). Under this vision around 40 GW of renewable energy capacity are to be added by that date. Alongside this regional target, individual countries envision a further push for renewables-based power and a myriad of measures, such as revising feed-in tariffs, net-metering schemes, auction mechanisms, facilitating access to land and surface water for floating projects, are envisaged to support the development.

Indeed, there are strong ambitions towards scaling up of renewables. Particularly, Vietnam in the abovementioned draft PDP8 considers 45 GW of renewable capacity by 2030 (an increase of nearly 70% in the renewable capacity target from the amended PDP7) and 127 GW by 2045 when its share reaches 46% of the total installed capacity. Currently untapped wind power is anticipated to lead additions, featuring 60 GW growth between 2020 and 2045 (7). Thailand, within the 10-year Alternative Energy Development Plan, aims to cover 33% of electricity needs from renewables (including hydro) by 2037. Renewables are set to reach 29 GW, amounting to around 35% of the total installed capacity in 2037 (8). The Philippines, in the draft of the new version of the National Renewable Energy Program, has set a target to achieve renewables’ share in the power generation mix of 37% by 2030 and 56% by 2040 (9). Indonesia also aims to increase substantially the role of renewables for electricity generation. It is underpinned by the overall policy orientation to raise their share in the primary energy mix from 9% in 2020 to 23% by 2025 and 31% by 2050. In accordance with the draft of the National Electricity Supply Business Plan 2021-2030, Indonesia’s renewables capacity between 2021 and 2025 is set to boost by 11.7 GW (10).

Despite these ambitious plans, several challenges are expected to affect the pace of renewables’ deployment. Intensive introduction of intermittent renewable energy will be hindered by: 1) economic difficulties post-COVID-19 to fund costly projects; 2) bottlenecks in the electricity transmission networks; 3) current underinvestment in grid modernisation; 4) insufficient availability of land to allocate large-scale renewable projects; and, 5) the existing inflexibility of power systems dominated by coal-fired generation. This is where gas-fired power plants will play a critical role regionally, being a significant component for the transition away from coal-fired generation, while complementing variable renewables, and stabilising ever-more complex grids.

In general, a number of countries are highly reliant on natural gas for electricity. With an average share in the regional power generation mix of 36%, this fuel in 2019 accounted for 94% in Singapore, 61% in Thailand, 39% in Myanmar and 37% in Malaysia, while it played a more modest role in Vietnam, the Philippines, and Indonesia, amounting to 23%, 23%, and 20%, respectively. Coal-to-gas switching potential as well as strong electricity demand growth mean that natural gas could maintain or even strengthen its position over decades. The key drivers will be the availability of indigenous gas production, as many countries face the depletion of existing domestic assets, and the ability to create import opportunities for LNG.

Policy incentives and ongoing market reforms, which support competition and attract upstream and infrastructure investments, are assumed to slow down the long-term decline of regional gas domestic production. Recent discoveries, including large ones such as Ken Bau

in Vietnam, Lang Lebah in Malaysia, and Kali Berau Dalam in Indonesia, are expected to sustain this trend, however the development of some projects could be hindered due to difficult geographical (located far away from demand centres) and geological conditions, problems of impurities and contaminations. Thus, taking into account the rising natural gas usage in the power generation, industry and transport sector, the GECF predicts, that ASEAN as a whole will transform into a net gas importer in the early 2030s (11). For comparison, ASEAN Center for Energy in the 6th Energy Outlook (November 2020) considers that region’s self-sufficiency in natural gas will come to an end by 2026 (AMS targets scenario) or by 2029 (APAEC targets scenario) (12). Wood Mackenzie foresees ASEAN demand for natural gas to surpass local production in around 2026 (13). ERIA anticipates that only Malaysia and Brunei Darussalam will keep their export positions until 2040 (14).

This will bring LNG imports to the forefront, while the development of LNG-to-power supply chains and interconnectivity, including the Trans-ASEAN Gas Pipeline project, will be pivotal factors, facilitating the attraction of LNG in the region. At the moment, there are nine LNG receiving terminals in five ASEAN countries with a total capacity of 38.75 million tonnes per annum (mtpa) and regasification capacity will grow rapidly. Moreover, Singapore is looking to become a leading gas hub in the region. There is also an alternative project of gas hub creation in Thailand, based on a receiving terminal in Map Ta Phut.

A strong impetus will stem from the advancement of intra-country LNG trade in Indonesia, making gas accessible to the entirety of the archipelago. The long-term infrastructure plan envisages the allocation of small-scale terminals coupled with integrated generators across 32 locations in Jawa, Sulawesi and West Kalimantan (15). Recently, there has been an announcement that the government will begin to build a system of seaborne electricity supply networks, powered by LNG, in order to deliver electricity to islands (up to 10 islands at the initial stage of the plan) that currently rely on diesel generation units (16). Moreover, the Indonesia’s first LNG-to-power project, the 1.76 GW Java-1 plant integrated with floating storage and regasification unit (FSRU), will commence operations this year.

Meanwhile, Myanmar commissioned its first 477 MW LNG-to-power plant in Thaketa in June 2020 and LNG import facility (floating storage unit, FSU), located on the Yangon River, also began to supply natural gas to the 350 MW power plant in Thanlyin and 150 MW in Kyaukpyu. Another gas-fired power plant in Thilawa (1.2 GW), sourced by LNG, is expected to come online by 2024. With the aim of reaching universal electricity access by 2030, Myanmar plans to boost gas-fired power plant deployment and is building six LNG-to-power projects with a total installed capacity of 4 GW (17).

Perhaps, the most vibrant example of development in this sphere is represented by Vietnam. The country is not yet importing LNG, but plans, unveiled in the draft PDP8, are attracting the industry’s attention. The draft’s base-load scenario proposes significant ramp-up of gas-fired capacity from 7 GW in 2020 to 29 GW by 2030 and 67 GW by 2045, with additional capacities to be mainly LNG-based. Hai Linh's LNG terminal in Vung Tau-Ba Ria province is on-track to become the first LNG regasification project in Vietnam (set to start operations in Q2 2021) to supply the Hiep Phuoc power plant expansion with up to 1.2 GW of capacity. Another receiving terminal at Thi Vai is under construction (phase 1 is set to be completed in 2022-2023) and will be used to fuel new power plants Nhon Trach 3 & 4 (total capacity of 1.5 GW). Further down the pipeline, Bac Lieu LNG-to-power project (3.2 GW) in the Mekong Delta region is being targeted for start-up in 2024 (18).

The future for gas-fired generation in ASEAN

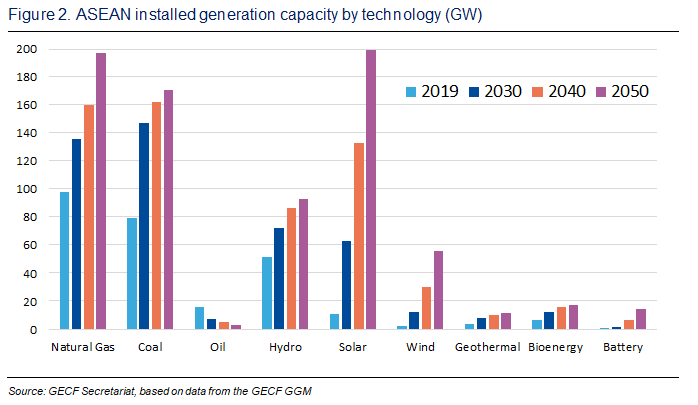

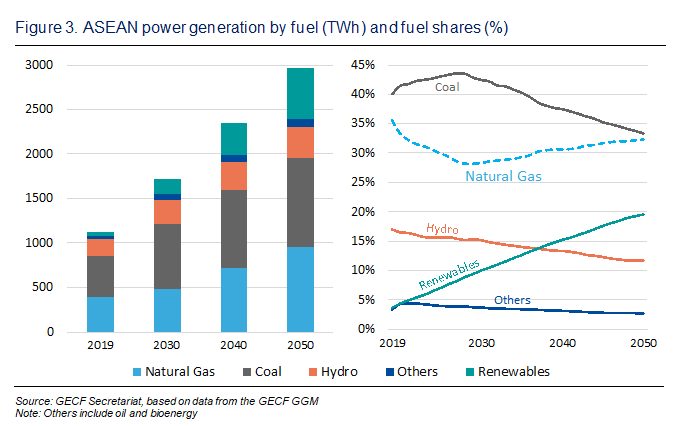

In line with electricity demand increase, electricity generation in ASEAN is forecast to grow 2.6-fold to about 2,970 TWh in 2050. Considering projects under construction as well as an assessment of energy policies and long-term capacity additions, the region’s installed generation capacity will almost triple to 760 GW in 2050. Coal will continue to expand across ASEAN and the total coal-fired capacity will reach 170 GW in 2050 (net capacity additions of 90 GW). Gas-fired capacity will rise from 98 GW to nearly 200 GW by mid-century, driven by developments in Indonesia, Vietnam, Thailand, and Myanmar. Renewables, such as solar, wind and geothermal, and hydropower will comprise almost 60% of all capacity additions, reaching around 360 GW by 2050, of which solar and wind will make the largest contributions. The development of the ASEAN Power Grid is also taken into consideration, which will facilitate the promotion and scaling-up of renewables.

Gas-fired generation is forecast to contribute to 30% of the increase in electricity supply through to 2050. This will translate into higher natural gas demand of ASEAN countries in the power generation sector, adding about 110 bcm over the next three decades to 200 bcm in 2050. LNG will bridge a widening gap of field depletion and lack of new indigenous resources, however more pronounced sectoral gas demand growth will be stifled by competition from cheaper coal that will be critical to revitalising economies in the aftermath of COVID-19 and to keeping pace with growing electricity needs.

It is also expected, that ASEAN countries will experience some delays in the commissioning of regasification terminals and new gas-fired power capacities, impacted by COVID-19 and capital spending cuts. It could lead to a higher coal utilisation in the following 5-7 years. Overall, coal is projected to be the largest generation source, amounting to 42% by 2030 and 33% by 2050 of the total regional electricity supply. In its turn, gas-fired generation, based on indigenous gas production and LNG imports, is set to maintain a strong foothold and provide above 30% of the power generation mix in the second part of the outlook period.

Renewables, on the strength of policy support and declining technology costs, are starting to alter the mix that - together with expanding hydropower - will meet around 40% of the projected increase in total power output. The share of renewables in regional electricity supply is forecast to almost quintuple, reaching 20% in 2050. In this context, gas-fired power plants, given their effective operations in baseload, flexibility options, and short start-up times, will play a central role, specifically beyond 2030, helping to sustain the transition away from more carbon intensive coal and accommodate higher share of renewables into the grid.

To conclude, electricity requirements in the ASEAN region are vast and natural gas together with renewables should be at the forefront in meeting these needs while reducing the environmental footprint. The existence of abundant and cheap coal resources cannot be simply set aside, however, there is even a larger potential for coal-to-gas switching in the power sector if more favourable policy measures are undertaken and gas-based infrastructure affordability grows. This corresponds to the 2019 Malabo Declaration at the outcome of the 5th GECF Gas Summit of Heads of States and Government (19), which emphasised the importance of cooperation amongst various stakeholders to ensure the stability of gas markets and the security of demand and supply of natural gas. Given ASEAN’s aspiration to propel energy transition into more sustainable and resilient energy systems using natural gas, the GECF Countries as reliable suppliers are striving to support these efforts and to cater for growing energy and electricity demand in this important economic region of the world.