We think interest in Sun Cable assets will be high, and that the project may well be viable. Yet as an external analyst without access to inside information, the risk always is that you are talking bull sh**. Goodness knows that’s been the case often enough in the past for this analyst.

What we know are the facts about the price of electricity in Singapore, Singapore’s demand, and the likely cost of the solar.

What is more uncertain is the cost of the batteries and the cable. We know that the project has a lot of friends – that is, state and federal governments and the Singapore government. It seems to have one main opponent.

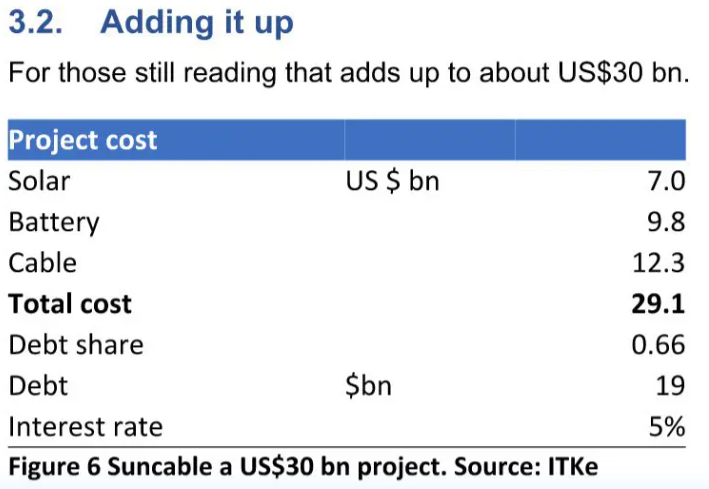

Sun Cable can potentially earn a 10% pretax IRR at a $US30 billion cost

In this sketch I take a look at the potential for Sun Cable from first principles.

I ignore most of the information published in the media about Sun Cable, other than the length of the cable, and also ignore most of the information in the EIS. The EIS is generally the starting point for research when no other information is available.

In research at an investment bank one of the main keys to success is to understand what the client wants and then give it to them.

From Sun Cable’s perspective, I understand the client to be electricity authorities in Singapore. On 1 July 2022 the Energy Market Authority of Singapore [EMCSG] issued a second Request for Proposal [RFP2] for import and supply of power to Singapore with submissions due by Dec 2023. 30-40 participants responded to RFP1 which was for 1.2GW of power.

Singapore, which currently has an average power demand of about 7GW – all or virtually all of which is gas fuelled – wants to import 4GW of power by 2035.

Note that the target is expressed in power rather than energy, with criteria based on reliability, track record, cost competitiveness and carbon. Coal generation proposals are not acceptable.

In ITK’s opinion, Singapore will want more than one importer. And just as clearly Australia is regarded as excellent potential supplier. Indeed some of the gas/LNG Singapore currently imports is from Shell’s QCLNG plant. Some of Singapore’s gas plants need to be replaced.

Next thing to note is that the client expects to pay a high price, at least equivalent to the current gas fuelled spot electricity price plus a carbon shadow price.

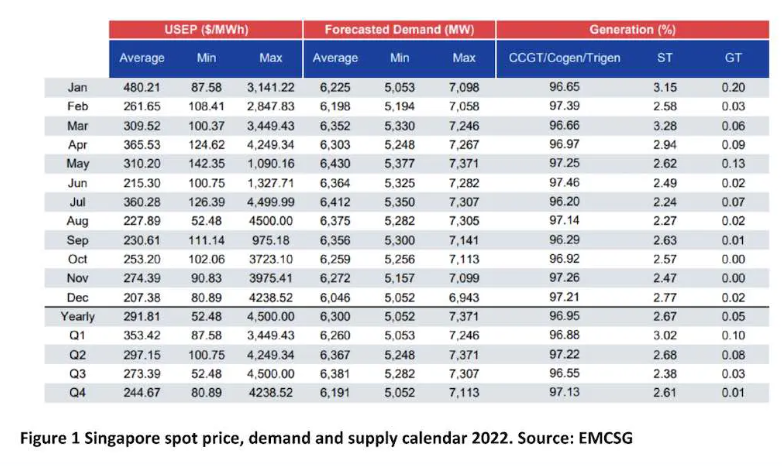

Electricity from imported LNG is expensive. The following data is for calendar 2022. The USEP is the energy spot price in Singapore dollars. $S1.00 = $US0.76

These prices exclude any carbon cost. However, it is clear that Singapore in this tender has at least a shadow carbon cost in mind. It wishes to decarbonise.

The medium-term outlook for LNG prices is unclear. At $US10/GJ delivered after regasification a price of roughly $US110/MWh is required for a combined cycle station with capacity factor of 50% and no carbon cost. At $15/GJ then that’s more like $US160/MWh

For that reason I consider that a reasonable target price of $S230 ($US175) a MWh real is an appropriate target price to calculate project value for Sun Cable. Obviously, any actual model would have lots of different scenarios.

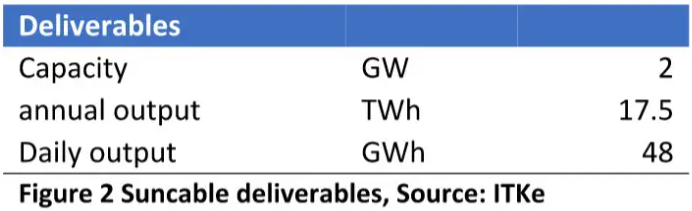

We assume that Sun Cable could, at most, expect to get a contract for 2GW. Note this is 2GW, whereas most media talks about Sun Cable aiming to have 20GW of DC solar panel capacity.

The tender winner also has to find the retailer in Singapore, and I ignore this and assume that for financing purposes the retailer will have the same credit rating as the Singapore government.

In short, the “model” is based on 2GW supplied continuously at a received price of $US175/MWh.

About 7GW of solar is needed for 2GW/24/365 energy

Sun Cable proposes to supply 2GW of power 24 hours a day 365 days a year. There may be a number of reasons for this, but a plausible one is to make maximum use of the cable.

Yet it comes at a cost. Singapore has existing gas generation that could do some or indeed all of the firming. To avoid the use of the gas generation in Singapore requires all the batteries to be installed for Sun Cable.

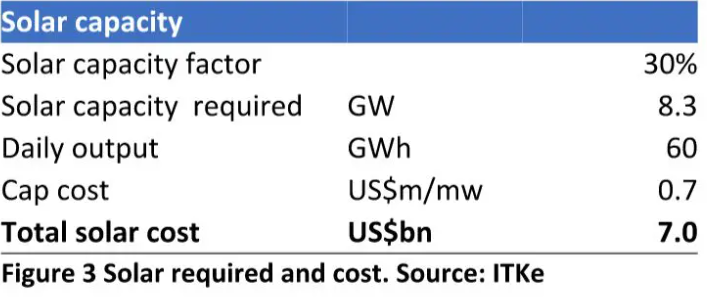

Solar required

The solar capacity required is assumed to be deliverables + 20% for losses, etc. I based this on conventional single axis tracking solar rather than the 5B concept. I used a capital cost of $A1.00/Watt and assumed an AC capacity factor of 30% based on an inverter load factor of 1.2.

Really, these numbers are just out of my head. The EPC of solar projects in Australia is typically about $A1.30/Watt but this project’s scale and amortising overheads bring the unit cost down, partly offset by remote working conditions.

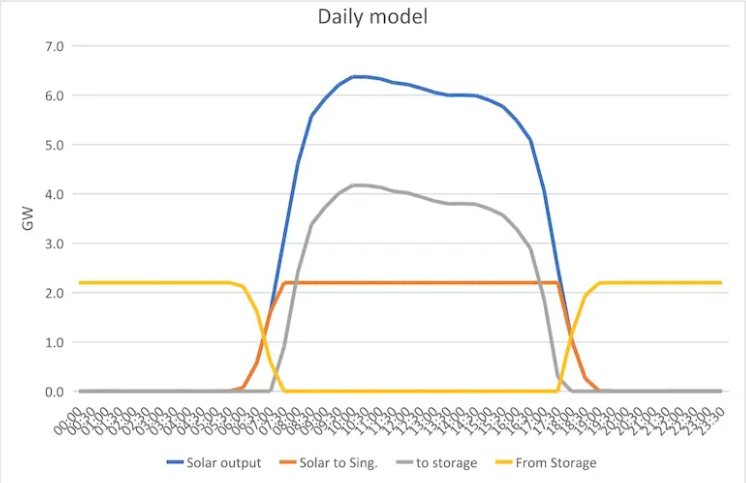

Again, you only need this much solar because you have to provide power 24/7 rather than for 8-12 hours. Most firmed solar plants, in say the US, aim to have four hours of battery rather than, say, the 16 hours this project requires. If you only want to run for 12 hours you need a lot less battery.

Battery storage required

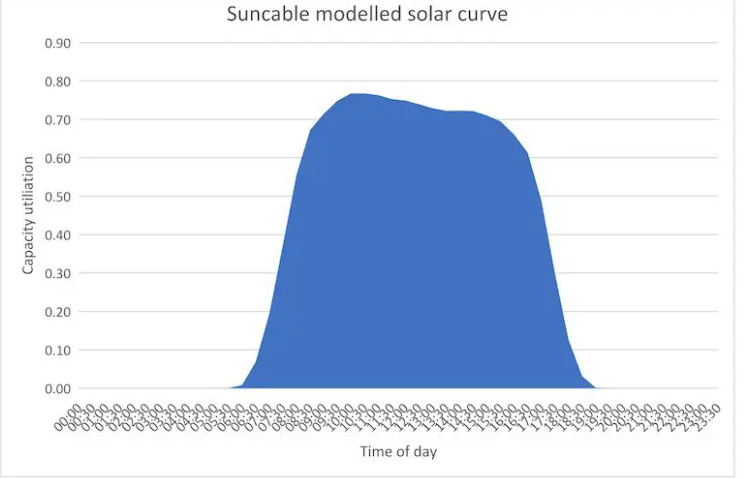

Normally, I use the Moree solar plant, the first one built with single axis tracking in Australia, as a model for most other plants, but as good as its irradiance is, it’s probably not as good as Sun Cable’s proposed site.

The most comparable farms are likely in Western Australia, but I don’t have access to their data as easily so I’ve used Rugby Run, which has an AC capacity factor of 28%. I scaled this to 30% to allow for even better irradiation and a slightly higher inverter load factor.

From this and the requirement that every half hour we have to send 2GW (2.2GW with losses) off to Singapore we get the following model.

And from this we can calculate that about 35GWh of storage – actually a bit less, but let’s allow for winter and rain – will do the job.

Two-hour batteries are about $A580/MWh recently, but so much more duration and the scale and some cost normalisation will get us back to, say, $US385/MWh.

The duration is sufficient that there is likely a role for flow batteries which, although less proven, have better economics at long duration. Mixing in flow batteries further reduces the unit cost to say $US280/MWh

And let’s assume that by upping the opex (cell and inverter replacement and flow battery components) we can make the batteries last 30 years. 20-year warranties are already available. Over 30 years it’s likely that the batteries would be fully replaced.

On to the cable

So far, it’s been familiar territory – that’s the Northern Territory, right? Let’s move on to the cable.

The cable reminds me of an initial Telstra report my ex boss and good friend wrote many, many years ago before any telco companies were listed in Australia and featured a front cover illustration of two boys talking through tin cans connected by a string. My knowledge of DC cables is about the same level.

However, we can turn to academia for a reference, despite the hazards of relying on just one report written by folk who haven’t actually built a cable themselves.

“Technical and economic demands of HVDC submarine cable technology for Global Energy Interconnection” was submitted to “Global Energy Interconnection” in December 2019 and publish April 2020. It is thus a relatively recent reference by seven named authors. It’s a good read if you are interested in DC submarine cables.

(I am a financial analyst with zero engineering qualifications and readers should bear that in mind. But, after all, there are so many other assumptions in this keyboard warrior bubble piece that what’s a few more waffles here or there?)

It has to be DC because only DC cable works under water for any meaningful distance. AC has unacceptable losses used under water.

It also has to have a very high voltage. The authors state that a 700kV cable has maxim capacity of 3.4GW. The article goes on to talk about 800kV cable and the insulation materials required for that.

However, it noted that at the time of writing:

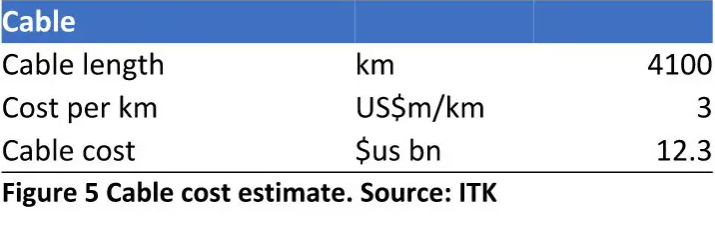

“In terms of economy, the current total cost of the ±200~600 kV bipolar UHV DC submarine cable is in the range of $1.0~2.6 million/km that is 5~10 times higher than that of overhead lines. Additionally, the cost per unit capacity of this type of cable declines as the voltage and capacity increase.”

If I ignored likely cost increases since article submission and assumed that longer distances would have lower unit costs, and that the cable is likely to be at the higher end of the voltage level, then I might choose a cost around US $US1m/km.

But instead, let’s use $US3m/km and for 4000km, and ignoring the transmission within Australia that gets us to around $US12-13 billion for the cable. I suspect the project sponsor will laugh at this number with an “I wish!”

That number quoted allows for a no-doubt incorrect estimate of terminal station capex, which typically are the largest part of a DC cable cost.

It’s worth noting that manufacturing cable is a skill that is within Australia’s capabilities and that a cable factory could be located in whichever state would like to have it the most.

Increasing global cable capacity would be a good thing and in my opinion likely anyway. This cable would likely chew up about 50% of current global manufacturing capacity for this type of cable.

It’s my opinion that there would be some scope to consider project variations where there were less batteries and some of the existing gas power is used for firming.

However, this would reduce the cable capacity utilisation. Nevertheless, it might improve the project economics by allowing the storage capex to be deferred. Still that is a detail.

Pretax, ungeared IRR of 10%

I allow about 15% opex per year. That $0.5 billion per year real of opex also has to cover maintenance capex, which I expect mostly relates to the batteries.

Ignoring abandonment costs and running the project over 30 years, yet noting that the life of the cable and the panels is likely 40 years I can get an ungeared pretax IRR of 10%.. By contrast with 66% debt at a cost of 5% the pretax IRR pre abandonment cost is 6.6%

In my opinion, if that was the case – and that’s a big “if” – it puts the project into the viable window.

Project revenue is about $US3.1 billion per year and EBITDA about $US2.6 billion. So it’s a 12-year payback if you want to think about it that way.

There are, of course, many potential spin-off benefits to employment, potentially also to local manufacturing and to improving geopolitical relationships.

Having the cable increases optionality; a second cable would likely be cheaper, and so on.

In short, the analysis in this note, such as it is, and it is only a sketch, tends to support the Sun Cable and founders’ view of the project rather than the Squadron Energy view.

Of course, this is only a desktop analyst’s view rather than one informed by access to any actual project information.