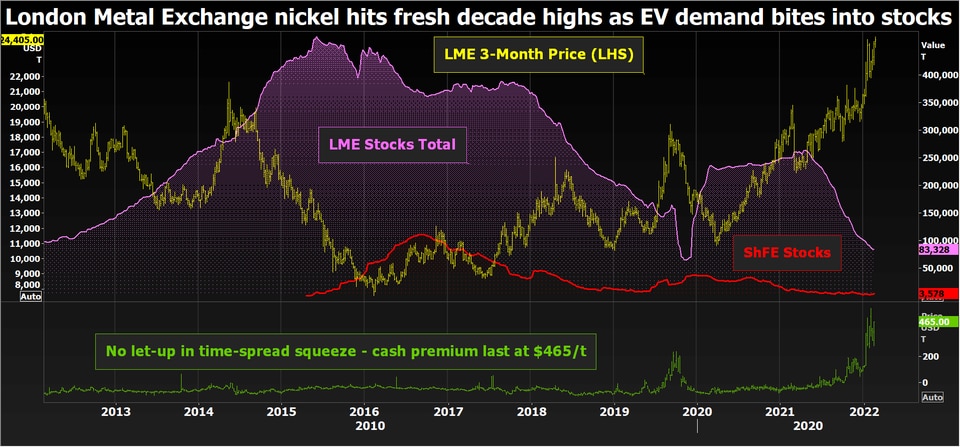

Nickel rose to its highest level in more than a decade on Monday morning.

London Metal Exchange (LME) three-month nickel has broken through January's high of $24,435 per tonne to reach $24,610, a level last traded in 2011.

Time-spreads remain in the grip of a ferocious squeeze, the cash premium closing last week valued at $465 per tonne.

The huge incentive for LME delivery has drawn some metal into exchange warehouses but not enough to halt the running downtrend.

The possibility of sanctions on Russia, which accounts for about 7% of global production and is a major exporter to both Western and Chinese markets, is in the bullish mix.

But the underlying driver of nickel's price rally is electric.

LME nickel hits fresh decade highs as battery demand bites into stocks

SUPERCHARGING DEMAND

A record 286.2 gigawatt hours (GWh) of passenger electric vehicle (EV) battery capacity was deployed onto roads globally last year, according to Adamas Intelligence.

That represented a 113% increase on 2020 as new energy vehicle sales continued to grow strongly in China, the world's largest market, and exploded in Europe.

The EV battery sector is a smaller user of nickel than the stainless steel sector but it is growing at a much faster pace.

Not all batteries use nickel. A new generation of cheaper lithium-iron-phosphate batteries is gaining market share in China.

But 54% of the battery capacity deployed last year used high-nickel-content cathode chemistry, according to Adamas Intelligence. Low-nickel chemistry accounted for 26% and no-nickel products just 20%.

The amount of nickel deployed in new EVs last December was a record 19,651 tonnes, up 44% year-on-year and up 29% month-on-month, the consultancy said.

The EV revolution seems to be fast approaching a state of critical mass, which is translating into record-breaking price runs for cathode inputs such as nickel and cobalt and, of course, lithium itself.

THE RIGHT STUFF

Surging demand for battery metals reflects both the exponential rise in EV sales and the build-out of a global battery manufacturing industry, each new gigafactory representing an extra pull on metal stocks.

That pull is complicated in the case of nickel because not all of it is suitable for conversion into the sulphate which is blended into the precursor mix.

Class I nickel, defined as containing a minimum 99.8% metal, is very much the right stuff. It's also the stuff that is traded and stored on both the LME and the Shanghai Futures Exchange.

Which is why there has been such a scramble for exchange metal. Shanghai inventory has been running on empty for many months and currently sits at just 5,301 tonnes.

This time last year LME warehouses held almost 295,000 tonnes of nickel, 250,000 tonnes in the form of registered inventory and 45,000 tonnes in off-market shadow inventory.

LME stocks today stand at 83,274 tonnes, of which 52% has been cancelled and is awaiting physical load-out.

Shadow stocks had shrunk to just 2,687 tonnes at the end of December, according to the LME's most recent off-warrant stocks report.

The run on stocks is keeping time-spreads volatile and the backwardation elevated. The absence of fresh warranting - just 600 tonnes have been delivered so far this month - attests to simultaneous tightness in the physical supply chain, where premiums are also surging.

INDONESIA TO THE RESCUE?

Nickel's latest price highs come hot on the heels of news that China's Tsingshan has made its first delivery of Indonesian nickel matte to Zhejiang Huayou Cobalt Co Ltd .

This is a milestone development, marking a new processing route from laterite ore to battery quality material.

Indonesia is the world's largest producer of nickel but has historically supplied it in the form of nickel pig iron to the stainless steel sector.

It is now the experimental heart of the global battery-grade nickel sector with some operators following Tsingshan down the matte processing path and others opting for high-pressure-acid-leaching technology.

The scale of Indonesia's nickel build-out is hard to overstate. The country's mined production leapt by 35% to 936,000 tonnes in the first 11 months of 2021, according to the International Nickel Study Group.

That breakneck expansion should, in theory, mean much improved availability of battery-grade material and a resulting drop in demand for Class I nickel.

Most analysts are bullish on price for the first half of the year but more cautious thereafter because of this building Indonesian supply wave.

The reality may, however, may be messier.

SPLITTING THE MARKET

What's being mined and processed in Indonesia isn't going to go anywhere near an exchange warehouse.

It won't be in the right form to qualify for exchange delivery, meaning its market impact will be muted until such time as it displaces enough Class I metal to stop visible stocks sliding.

In the interim, nickel pricing will be determined by how much, or how little, metal is sitting in exchange warehouses.

A more fundamental issue, perhaps, is whether Indonesia's nickel rush will do much to satiate Western demand for battery-grade metal.

The country's production sector is dominated by Chinese entities, meaning most of the extra nickel supply will ultimately be channeled to Chinese battery makers to meet domestic demand.

Even if Western players wanted to muscle in, it's not clear their ultimate customers, carmakers, would want them to do so.

Indonesian nickel comes with a high carbon footprint due to the energy-intensive process route and the fact that coal is a core component of the country's energy mix.

Moreover, there is increased scrutiny of nickel mining's broader environmental and social impacts in Indonesia.

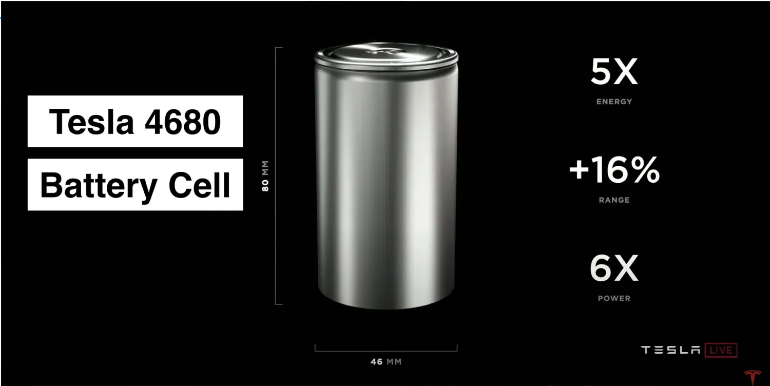

Tesla (TSLA.O) has signed off-take agreements with BHP Group (BHP.AX) for Australian nickel, Trafigura for New Caledonian nickel and Talon Metals (TLO.TO) for domestic U.S.-mined metal.

That says much about where the green pioneer thinks it can get green metal.

If other car manufacturers come to the same conclusion, the impact of Indonesia's supply surge may be much diminished outside of China.

Ironically, just as Tsingshan is closing the chemistry gap between Class I and other forms of nickel, the end-user market gap may be widening.

The opinions expressed here are those of the author, a columnist for Reuters.