The Korea Automobile & Mobility Association reported that from January to April 2025, only 18 hydrogen vehicles, encompassing both passenger and commercial models, were exported, marking a 70 percent decrease from the 60 units exported during the same period last year.

On the domestic front, sales of hydrogen vehicles reached 965 units in the first four months of 2025. This figure raises concerns that the annual total may fall to its lowest level in recent years, reflecting challenges in market growth.

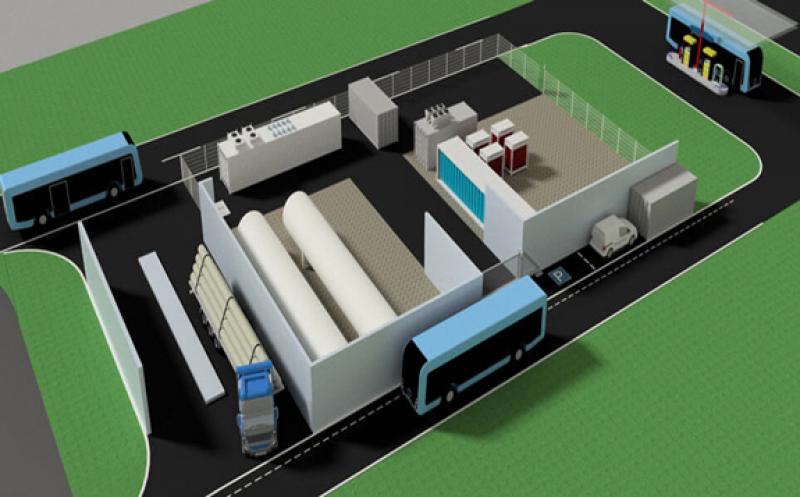

Hyundai Motor, a leader in the global hydrogen vehicle market with models such as the Nexo and the Xcient commercial truck, is facing difficulties due to limited model options and insufficient hydrogen refueling infrastructure. These factors have hindered the company’s ability to maintain its earlier momentum.

Export figures peaked at 1,121 units in 2021 after the Nexo’s launch in 2018 but have since declined steadily. Domestic sales also saw a high of 10,328 units in 2022, dropping to 4,707 in 2023 and further to 3,787 in 2024, underscoring the ongoing challenges in the sector.

Despite the downturn, industry experts emphasize the long-term potential of hydrogen vehicles as a critical component of future mobility. They advocate for increased government support to bolster the sector. “The global hydrogen car market is still small but holds great potential,” said Kim Pil-soo, a professor of automotive engineering at Daelim University. “It should be viewed as a next-generation investment and supported through a broader hydrogen value chain strategy.”

The industry’s challenges highlight the need for expanded infrastructure and diverse vehicle offerings to stimulate demand. Stakeholders remain optimistic that strategic investments and policy support could help hydrogen vehicles regain traction in Korea and beyond.