In late 2024, the import tax on solar modules rose from 9.6% to 25%, increasing project costs by over 8%, per Greener consultancy. The government also ended import quotas that would have reduced tax burdens until June 2027. Officials stated the changes aim to balance competition between local and imported products, supporting job growth and investment in Brazil’s solar manufacturing sector, which has a capacity of about 1 GW annually against a projected demand of 17.8 GW.

While import values for unassembled cells fell from $1.81 billion to $1.67 billion year-over-year, import volumes grew 46.7%, from 9 million to 13.2 million units. Complete PV systems saw increases in both value and volume. In 2024, Brazil imported $2.62 billion FOB of PV equipment, with assembled modules making up 99.7% ($2.61 billion), unassembled cells 0.22% ($5.72 million), and PV generators 0.8% ($2.27 million). Total import value decreased from $3.8 billion in 2023, but import volume rose to 476 million units from 198 million.

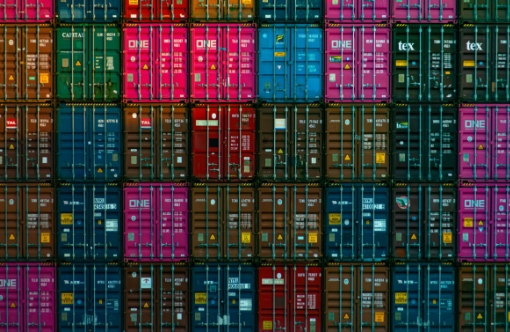

Port dynamics shifted in 2025. The Port of Santos, handling 46% of 2024 imports by value ($1.21 billion), fell to 40.1% through April 2025. Salvador Customs’ share grew from 8.6% to 12.3%. By unit count, Suape Port’s share rose from 18% to 29%, surpassing Santos. Thiago Rios, CEO of MTR Solar, said: “Most equipment arrives through Southeast ports and travels long distances inland, raising costs and risks.”

New trade routes are easing logistics. In April 2025, a direct shipping line from Gaolan Port, Zhuhai, China, to Santana (Amapá) and Salvador (Bahia) began, cutting transit time by up to 15 days. Pansarella added: “The new connection could reduce logistics costs by more than 30%.” The Ministry of Ports and Airports reported delivery times of 30–35 days. The Port of Pecém (Ceará) is also expected to benefit. Rios emphasized: “Faster shipping could reshape the supply chain, especially with China as the main supplier.”

Brazil is exploring a Brazil-Peru Bioceanic Corridor, linking Porto Sul (Ilhéus) to Chancay (Peru) via a transcontinental railway through Bahia, Goiás, Mato Grosso, Rondônia, and Acre. Leonardo Ribeiro, national secretary for rail transport, stated: “Brazil exports $350 billion annually, with one-third to China, mostly iron ore and soybeans.” This corridor could lower costs for solar components like trackers and cables, supporting long-term market growth.