A view of the Neste logo at the Neste refinery located in Tuas South, Singapore May 16, 2023.

Neste's comparable earnings before interest, taxes, depreciation, and amortization (EBITDA) for the quarter reached 341 million euros ($401 million), a 42% increase from the previous year. This figure exceeded the average analyst forecast of 302.5 million euros, according to a company-provided consensus.

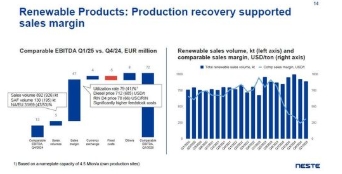

"Our sustainable aviation fuel sales increased close to 80% quarter on quarter, benefiting from additional SAF production capacity at our renewables refinery in Rotterdam," said CEO Heikki Malinen in a statement. The surge in SAF sales propelled the renewable products unit to a record quarterly sales volume of 1,096 thousand tonnes. Although the unit's sales margin dipped by 5% to $361 per tonne, it outperformed analysts' expectations of $329 per tonne.

"We saw positive developments in biofuel regulation both in the US and EU, largely supporting long-term renewables demand," Malinen added. These regulatory advancements are expected to bolster the market for renewable fuels in the coming years.

By 10:00 GMT, Neste’s shares had climbed 15%. Analysts at RBC noted in a research report that the second quarter served as a "key litmus test" for Neste’s new management, with the strong results fostering positive investor confidence.

Despite the strong performance, Malinen cautioned that market volatility persists, with challenges from global trade dynamics expected to continue. Neste has faced an oversupply in the renewable fuels market, which has impacted sales volumes and led to a workforce reduction of approximately 510 jobs worldwide earlier in 2025.

The company remains optimistic about its annual sales volumes improving from 2024 levels but anticipates the oversupply in the renewable fuels market to persist throughout the year. Malinen told Reuters that this oversupply could extend into 2026 or beyond, depending on regulatory developments in the European Union.

Additionally, broader market challenges, including weak demand and high input costs, have prompted Neste to revise its renewables sales margin forecast downward three times in 2024. These factors, combined with a global slowdown in green hydrogen projects, highlight ongoing pressures in the renewable energy sector.